IIB: standing the test of time

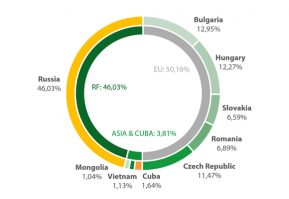

The International Investment Bank (IIB) is a multilateral development institution, created by member states in 1970. The “Agreement” to form the bank was signed on 10 July 1970 and registered with the United Nations Secretariat under number 11417.

The bank’s mission, as described by shareholders, is “to promote greater interconnections and integration between the economies of the bank member states, with the aim of achieving the conditions for balanced and inclusive growth, and competitive national economies, by drawing on existing historical bonds”.

IIB was originally founded as a financial tool for COMECON countries. The institution’s key objective was granting medium- and long-term loans for implementation of joint investment projects and development programmes, as well as providing financing to construct facilities to aid the economic development of the member states. IIB played a substantial role in trade relations between its members and provided large volumes of financing for these purposes.

With the disintegration of the Socialist Block, IIB – to a large extent – lost its focus and went into a period of protraction for nearly two decades without a sound lending policy or proper internal systems in place. In 1991, the German Democratic Republic faced dissolution and therefore terminated its membership with the bank. In 2000, Poland and Hungary also declared their intention to cancel their membership. During this challenging period for IIB, Russia (being the main shareholder and host-country) took the initiative and put serious effort into the institution to continue its existence. It approached remaining shareholders and initiated a large-scale reform of the bank, which all states unanimously supported.

In 2012, new management arrived and prepared a relaunch strategy of IIB in a record time, receiving a mandate from shareholders to start a comprehensive restructuring of the institution. This was successfully completed in 2018 by entry into force of new statutory documents and, with an introduction of a three-tier corporate management system, IIB finalised its transition into a modern, multilateral development bank.

Today, IIB is focused on medium- and long-term financing of projects aimed at the economic development of its member countries. Aiming to have a positive environmental and social impact, the bank provides loans directly, in collaboration with other banks or through financial intermediaries.

IIB’s key focus is on:

• Project finance.

•Trade operations between member states with

an emphasis on integration.

• Modernisation and renovation of infrastructure

• SME support.

• Sustainable development.

IIB’s current loan portfolio includes projects in nine shareholder countries in key strategic sectors including, agriculture, transport, energy, telecommunications and the food industry.

In accordance with the IIB’s current Development Strategy, by the end of 2022 it aims to:

• Raise total assets to €1.7bn and expand the loan portfolio to €1.2bn.

• Increase volume of bonds issuances including in national currencies of the member states.

• Become an acclaimed and unique lending institution capable of executing medium-sized projects to promote the development of the member states’ national economies.

• Put forward a recognisable value proposition on the markets of member states, play a prominent role in supporting financial transactions both between member states and third countries, which includes funding export/import operations and investment.

• Run a partnership network in each member state on the basis of long-term mutually advantageous relationships.

• Achieve and maintain long-term financial sustainability.

• Demonstrate sustainable profitability through its core activity.

• Expand its shareholder structure to strengthen the capital base and identify new financing opportunities.

• To reinforce the presence in certain geographical areas by opening local representative offices.

Historic move

In 2018, IIB shareholders unanimously supported Hungary’s proposal to relocate its headquarters from Moscow to Budapest – the first time in history a multilateral development bank had made such a move. Ever since its return to IIB in 2015, Hungary had been raising the issue of where the headquarters should be located. The move coincided with IIB completing its relaunch programme and becoming a modern institution compatible with global market player. The shareholders believed that acquiring a Central and Eastern Europe (CEE) address would enable the bank to achieve the following:

• Expand its international capital markets base.

• l Improve credit ratings.

• Ensure a substantial increase in capital, boost lending and investment activity.

• Increase brand awareness and attractiveness of the institute for new shareholders.

As the first multilateral development bank with its headquarters in the CEE region, IIB has now entered a new five-year cycle of its strategic development. It is an exciting time for the organisation as it looks forward boosting the medium- and long-term economic development of its member states.

Further information

iib.int/en

For more corporate finance news, follow The European