The driving force behind Bestinver Infra’s global success

John E. Kaye

- Published

- Banking & Finance, Home, Uncategorized

Powered by vast cross-sector expertise and decades of combined experience, meet the team shaping Bestinver’s infrastructure investment success

It has been three years since Bestinver launched its first infrastructure investment vehicle. The Spanish firm – with €5.7bn in assets under management – has 35-year legacy of managing liquid funds, but had never ventured into the alternative asset space. Yet, in less than three years it has now reached 700 investors with its first infrastructure fund – a €300m vehicle with a diversified portfolio across 13 countries. Behind the division’s success is a team of 11 professionals led by Francisco del Pozo, Head of Infrastructure Funds at Bestinver. “We are in the process of building Spain’s best infrastructure investment team,” says Del Pozo.

“Not only do we rely on a versatile, dedicated and globally-minded group of professionals, but we also have the support of Bestinver as a top financial group and Acciona as a multinational infrastructure force,” he adds. As the division prepares to launch new products in the future, Del Pozo also plans on growing the team further.

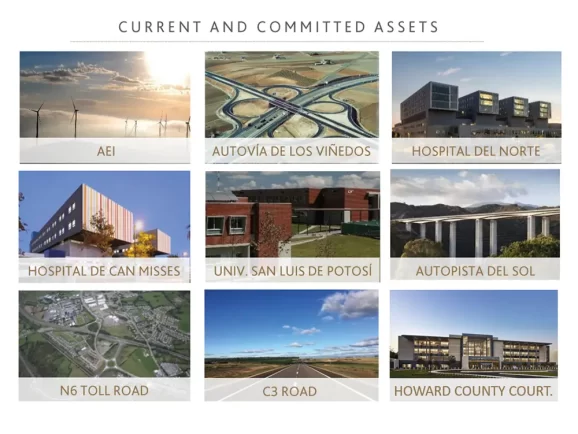

Bestinver’s first fund in this segment is Bestinver Infra, FCR, which focuses on transport assets, civil infrastructure, and renewable energy sectors. During the fund-raising period, it was able to invest close to 90% of its size and make distributions five times to investors. To handle such a rich array of investment opportunities, Bestinver counts on a multi-disciplined team of executives with decades of experience in the sector. Before joining Bestinver, Del Pozo was Managing Director of Macquarie Capital’s infrastructure team in New York. As Head of Infrastructure Funds, Del Pozo relies on Nicolás Corral and Juan Alcalá as Investment Directors in a team that is structured as an investment banking team. Corral has worked as CEO of Acciona’s Concession business as well as International Markets Development Director at transport infrastructure developer Cintra. Alcalá joined Bestinver from Cintra, where he served as Business Development Director across Australia, Europe and Emerging Markets.

“Being a part of Acciona provides a point of difference for Bestinver Infra,” says Corral. “Even though Bestinver Infra is a financial investor, we have the immense expertise and contact network of Acciona as an industrial player,” he adds.

Acciona’s international presence also helps greatly with Bestinver Infra’s global reach. However, a lot of it also comes from the team itself. “This is a team with extensive international experience and a nourished global network of contacts,” states Alcalá. “We have a combined experience of over 50 years, having executed infrastructure transactions worldwide valued at more than €16bn.”

Diverse portfolio

This global mindset is reflected in the fund’s diverse portfolio, which includes Mexico’s San Luis de Potosí University, Ireland’s N6 Toll Road, or Howard County First Circuit Courthouse in Maryland, USA. Nicolás Robles and Diego Martialay, Vice Presidents at Bestinver Infra, each have more than a decade of experience in entities such as Citi, DIF or Acciona. “I have worked in New York, Hong Kong, and Sydney. When thinking of comparably attractive opportunities in Spain, I struggled to find global projects that fit my trajectory – until I found Bestinver Infra,” explains Robles. “Yes, there are Spanish Infrastructure funds, but few invest internationally like Bestinver Infra does,” he adds.

The diversification of the vehicle is also cross-sector. Martialay brings in financial experience in the energy, water, transport, and social infrastructure sectors earned across five continents. “It is enriching to work on such a variety of assets here at Bestinver,” he explains. “We are all tied to the infrastructure sector, but we come from different backgrounds: some from the engineering world, others from the financial sector. That versatility is present in Bestinver through the support of its legal, commercial, and operations teams.”

Bestinver is focused on creating long-term value through active investing, meticulous analysis, and diversification – all within strict sustainability guidelines. That philosophy reflects on Bestinver Infra. Investors value its resilience and reliable returns, especially in an environment conditioned by rising inflation. Víctor Mahillo, Senior Associate at Bestinver Infra, has recently joined the company from Banco Santander. “Bestinver is one of the biggest financial firms in Spain,” he says. “Having seen Bestinver Infra build such a quality portfolio in a short period of time, it is exciting to think of its future launches and projects,” he adds. Javier Villen also joined as an Associate this year after graduating from an MBA at Columbia Business School. “I wanted to continue with my international career and Bestinver Infra fits perfectly,” he explains. “It has a highly experienced team with track record investing across the whole infrastructure sector globally, which is often difficult to find in Spain.”

Alejandra Llanza and Rodrigo Choya have been Analysts at Bestinver Infra almost from its inception. “In the beginning, Bestinver Infra was a new player and had yet to carve out a place for itself in the infrastructure market. But, three years later, what has become hard is managing all the opportunities that come knocking on our door”, explains Choya. Both analysts agree that the fund’s development has enriched their own advancement as professionals. “Being a part of Bestinver Infra has been such a unique opportunity”, says Llanza. “We work for an established firm like Bestinver but, having joined an emerging project like Bestinver Infra, we get to learn from all the different stages of its development: origination, investment, the active management of the portfolio.”

Looking into the future, Bestinver plans to reach a €1.5bn milestone in alternative assets within five years. Along with the Real Estate area and the recently launched alliance with BlackRock to grow in the private equity segment, the Infrastructure Division will play a key role in the expansion of Bestinver’s alternative assets value proposal. “Having seen Bestinver Infra’s track record so far, the firm is now looking forward to the launch of new products in the future,” says Del Pozo. “We hope many talented professionals can join us in this journey.”

Further information

www.bestinver.es

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group