Always evolving with the markets and the needs of its clients, Afore SURA continues to demonstrate why it is Mexico’s number one pension provider. Chief Investment Officer Andrés Moreno explains more

Afore SURA is truly committed to helping our clients finance their dreams. As a team of over 50 investment professionals, we are always looking for the best opportunities around the world. For the last four years, our team has obtained the highest rating in the Mexican pension fund industry from Morningstar analysts. We strive to offer the very best client service and have also been recognised in the local rankings as the leading Administrator of Retirement Funds (Afore) for the last five years.

Our service platform has been modernised with personalisation and innovative design to focus on our clients’ needs. We combine our in-house capabilities with fintech partnerships to ensure that younger clients can easily engage with their pension plans and begin saving money for the future – because it all begins today.

The economic environment and global financial markets continue to offer challenges and is highly demanding in terms of developing the optimal tools to make the correct investment decisions. However, no-one is better equipped to navigate these challenges than Afore SURA. We see the global economy as undergoing three secular transformations, which create this challenging environment:

- A profound energy transition to reduce its dependence on fossil fuels.

- A reorganisation of supply chains. This, due to Covid, sees firms looking to boost the reliability of their supply chains while sacrificing some of the price efficiencies that had dominated the globalisation phenomenon of the last 30 years.

- A geopolitically driven global adjustment of trade blocs, capital investments and strategic economic sectors. At the same time as this is all happening, the global economy is undergoing its usual cyclical fluctuations and is in the middle of the late cycle dynamics, that tend to be the most volatile economic moments. Add to this combination of factors the politicisation of so many things in our increasingly polarised world, everyone having opinions on social media, and it’s hard not to feel lost in the noise. A whole raft of other complexities make it necessary to consult with the experts in order to achieve our financial goals. That is why we at SURA prepare for, and understand these market challenges, so we can be close to our clients when they most need it.

The Afore SURA approach

Afore SURA has designed 13 different funds, all optimised for the needs of our diverse client base – which currently stands at over seven million. All the funds are supervised by expert investment teams comprising active fixed income strategists, currencies and credit specialists, global equities experts and alternative investments managers. There is also a team of risk analysts, managers and lawyers to help us make the best investment decisions at all times.

The only way in which investment portfolios can fare well in the current economic climate is to construct a balanced portfolio between fixed income assets with inflation protection and a smart credit exposure to healthy firms, as well as diversified equity holdings and a currency basket to manage underlying risks. At Afore SURA, we believe that inflation will continue to be an issue for developed economies, because all the aforementioned secular transitions imply higher prices, for energy, wages, across a wide basket of products. These transformations imply that there will be winners and losers, whether its firms, economic sectors and even countries and regions, and we have to make sure that our portfolios benefit from identifying both in every dimension.

Our platform of in-house expertise is complemented by the most successful fund managers around the world, so that when our clients make investments in different regions, they can be certain to be accompanied by a local expert there. Our global diversification looks for enhanced returns in all the markets in which we invest.

We also understand that in order to help our clients achieve their goals, some of these goals may be more short-term, and therefore, low volatility is paramount. We have designed shorter-horizon products that earn a return, but that give our clients less variability in their balance for short-term liquidity objectives. The cyclical aspects of the global economy (as mentioned) imply that central banks have to apply the brakes now that interest rates around the world are at historic highs: for example, in Mexico they have reached 11%’s. We believe that, as in every cycle, this severe medicine cannot be sustained for too long before driving an economy into recession, and therefore making these ultra-high rates an opportunity to invest. And our portfolios don’t have to increase duration risk significantly to achieve them. Our central bank in Mexico will follow the federal reserve bank of the US, but it seems that the full hiking cycle is already priced in our front-end rates.

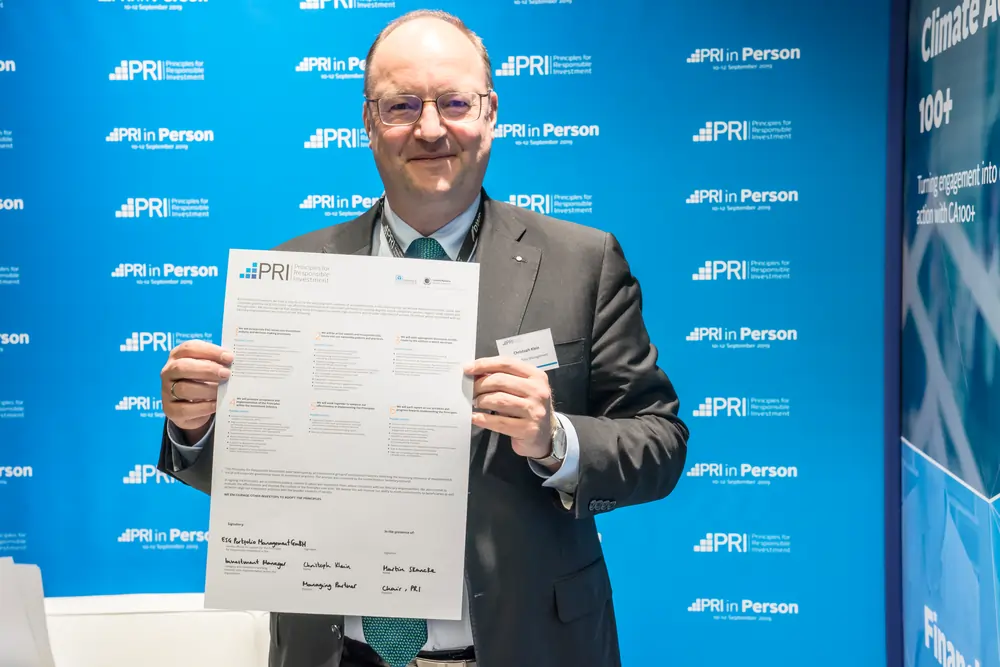

Another of our newer strategies is that of ESG Integration, which places a greater emphasis on the environmental impact of our portfolio companies. Our mandate is to help firms in our countries and our economies implement strategies to navigate the energy transition on a more sustainable trajectory. ESG Integration is about finding risks and opportunities for the firms in our investment portfolios. We are mindful that transition strategies require knowledge, time and financing. SURA is willing to provide all three, so that mitigating risks and finding the opportunities is done optimally and that it generates returns to our clients’ portfolio. We do not pursue exclusionary strategies which may result in damaging our clients’ portfolios, but a holistic strategy of stewardship and strong engagement that incentivises firms and economies to transition optimally to a more environmentally sustainable world.

At Afore SURA we evolve with markets and the needs of our clients, always exploring the best way to protect and enhance their savings, and seeking new client support initiatives to ensure we stay close at all times.

Further information