Payment terms do matter

John E. Kaye

- Published

- Banking & Finance, Home

A recent survey by Atradius unpacks payment practices across Europe, and reflects on different behaviours when it comes to settling an invoice

According to leading credit insurance specialist Atradius, it turns out that the length of your payment terms might actually influence the timeliness of payment by your B2B customers. By “timeliness”, this means how close to the due date your company is paid. A 20-day invoice paid 20 days after the due date has been paid in a far less timely manner than a 60-day invoice paid five days late.

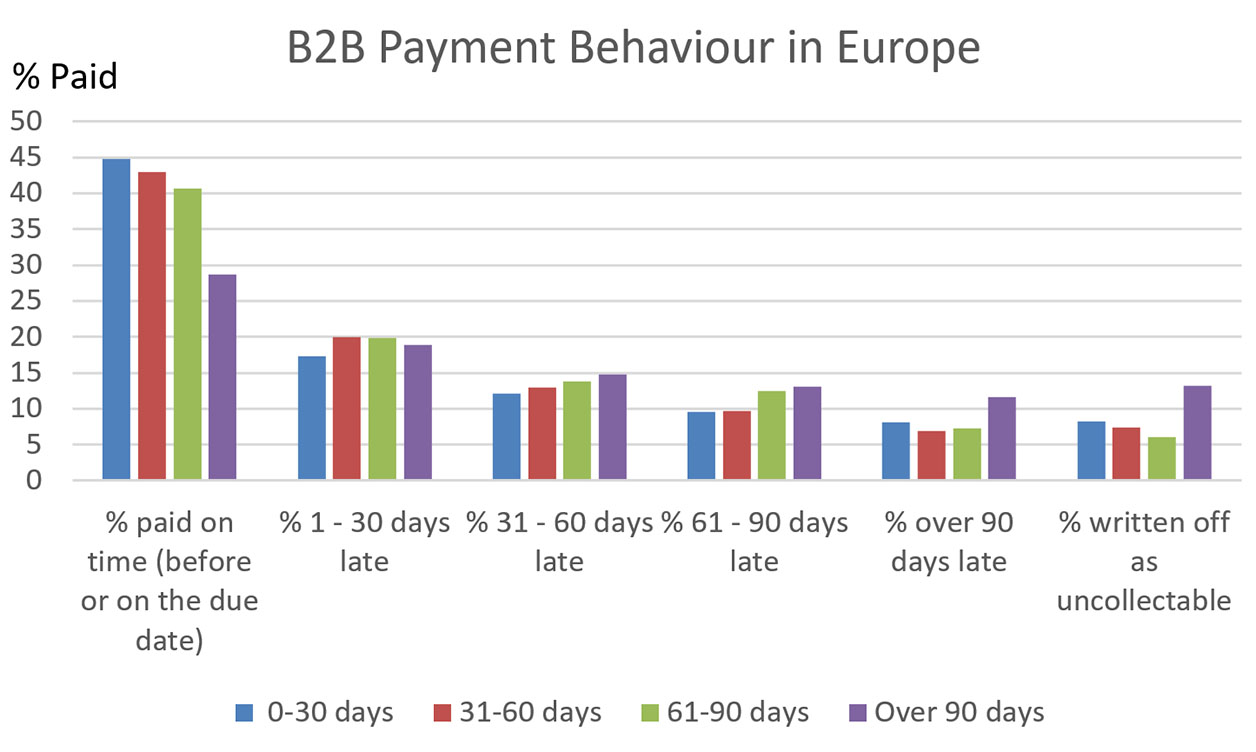

In Atradius’s annual payment practices survey the company looks at payment terms and payment duration of the B2B invoices of more than 3,000 companies in 20 European countries. When it comes to being paid on time, there was a big drop off once you got to longer payment terms of more than 90 days. Up to 90 days there was a gradual decline in the percentage of payments made by the invoice due date. For the majority of businesses this is not a big issue: 62% offer payment terms of 30 days or less. However, for the 9% that do give terms of more than 90 days there may be an even bigger problem. Late payment rates don’t really start to recover any ground on shorter payment terms until they are more than 60 days late. And there is not a significant difference until the more than 90 days late category. Even then, 13.2% of invoices with terms of more than 90 days were written off as uncollectible. This is more than 150% of the write off rate of invoices of less than 30 days, and twice that of invoices with 61 to 90 day terms.

On average, most invoices are for shorter terms. More than 60% are 30 days or shorter and more than 80% are 60 days or shorter. However, some markets are more likely to use longer terms and payment behaviour will vary from market to market. No matter which range of payment terms we look at, Western Europe overall has more problems with buyers’ payment behaviour than Eastern Europe. In Eastern Europe, only 5% of B2B invoices were written off compared to 10% in Western Europe. The Nordic markets of Sweden and Denmark were the most difficult to collect payment, with 14% of invoices in both countries written off as uncollectible.

Contributing factors

Although not a part of the Atradius survey, you may expect there to be a certain psychology to payment behaviour. For instance, longer payment terms might suggest less urgency to the buyer. If they are willing to wait that long then they won’t mind waiting another month or six. It could be a financing need, for instance, if the product is an intermediate version during the production of the final product, which the buyer then needs to collect payment on before they are able to pay their supplier. On the seller’s side, it could be that they send the buyer fewer reminders about the payment being due. The older an invoice the easier it is to forget. The higher write-off rate may also reflect a shorter amount of time between due date and write off date.

Shorter payment terms tend to keep things fresh in everyone’s mind. They also suggest greater urgency than longer terms do. Being a month late on 20-day terms sounds a lot worse than being a month late on 90-day terms. This again adds to the psychological urgency to pay for seller and buyer.

Setting aside the time it takes to get paid and just focusing on being paid, terms of 61 to 90 days seemed to be the sweet spot for the survey respondents. Only 6.1% of invoices with terms of 61 to 90 days were written off as uncollectible.

No time to be lax

Businesses are facing many risks simultaneously in the current economic environment. In many countries, inflation is at 20-year, and in some cases 40-year highs. Energy costs, supply chain problems, and strong demand have created the perfect storm for the high inflation. The promise of rising financing costs to temper inflation, the continued phase out of government stimulus and the ebb and flow of pandemic-driven lockdowns will only make growing your business more challenging. There is never a time when you should be lax in ensuring your invoices are paid. However, in 2022 global commerce is seeing a return to challenges not experienced in a decade. And in this environment, it is more important than ever that you ensure payment is secured.

For further information:

Atradius.co.uk

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group