Adapting to change and consensus

John E. Kaye

- Published

- Banking & Finance, Home

From positive trade agreements in Africa to the worrying power consumption of cryptocurrencies, Graham Bright of Euro Exim Bank looks at how organisations should be adapting to the new normal

If the recent UN COP26 has taught us anything, it is that nations mostly agree about the size of the challenge presented by climate change. There are positive signs that closer political and economic ties can be agreed, and most importantly, a consensus formed to clean up the planet for generations to come.

And consensus is not just confined to politics and climate change. The banking and insurance sectors are active in not only exploring, but also implementing practical solutions that will protect and promote collaborative trade around the world.

From standardised Basle III compliant policy in insurance markets, to interoperability in open banking platforms, the challenge is on. Above all, there seems to be a global acceptance to invest in, and navigate new technology projects that utilise blockchain and AI elements, with a vision to improve systems, supply and services.

There’s a whole wave of new ideas in the digital space, with advanced technologies and emerging fintech players challenging traditional delivery methods. The key drivers to competitive, sustainable international trade will be standardisation, rationalisation and re-usability of processes.

Yet this drive for smarter, faster, more efficient and trusted processes is not from within industry, but from tech-savvy consumers. Pre-pandemic consumer demand for goods is returning as confidence grows and the power of advertising re-emerges.

It is worth noting that although cyberattacks, global supply-chain issues, trade disputes, and conflicts in over 40 countries are making the world a more volatile place, consumers seem relatively unphased. Indeed, the possible absence of a Christmas turkey seems to be the biggest concern for many.

But let us get back to consensus and general agreement. Consensus can certainly be seen in the proliferation of free trade agreements. In Africa, putting aside nationalism, protectionism, isolationism, and long debated differences between nations, has finally resulted in 54 participants being able to collectively capitalise on the new demand for raw materials and services.

From vaccines to technology, the political will, tools, and finance have been made available to build manufacturing centres, therefore reducing dependency on expensive imports. African countries are developing the capacity to export competitively to new markets.

More importantly, the example of the African Continental Free Trade Area achieving a wide consensus – in the name of building resilience and creating prosperity – will no doubt benefit the whole continent. Yet, achieving this takes a lot of work, it means nations agreeing on process, taxonomies, customs duties, acceptable documents, payment methods, infrastructure routes and more besides.

African countries are now able to move beyond obsolete technologies and take advantage of the latest cost-effective communications networks. They can support mobile technology for payments, and take advantage of sophisticated applications. For example, new technology centres in Ethiopia are already contributing to this new tech infrastructure. These new apps are helping farmers in remote communities improve crop yields, and entrepreneurs to realise new projects by providing payment and loan gateways to connect. This empowerment through technology provides hope to some 30 million people living in extreme poverty, connecting the unbanked into the financial world and offering the chance to plan ahead and achieve security.

The consensus model for Africa will change perception, allowing it finally to be recognised as a global powerhouse – a major player in supply of the world’s limited precious resources.

Africa now has the potential to produce more goods locally and become more self-sufficient, rather than be at the mercy external market forces, excessive cost of loans and dependency on international support and foreign aid. It is alarming to think that without investment and further industrial development, the World Bank forecasts that 90% of the world’s poor will reside in Africa by 2030.

Ultimately, by standardising and harmonising both international and domestic regulatory practice, reducing and simplifying tariff barriers and minimising punitive tit-for-tat tariff measures, technology will be a critical factor in assisting with economic efficiency – digitalising process for faster, trusted, cost-effective outcomes for all.

Today, there are hundreds of multilateral and bilateral trade agreements around the world, covering geography, agriculture, IT, intellectual property etc. And the goal is not always profit, but fair, sustainable trade.

The importance of these agreements and their action cannot be underestimated, and as living with the pandemic becomes the new normal, there are signs that trade is edging back to pre-Covid levels. There is cautious optimism on the high streets and improved global trade, albeit with higher prices and threat of rising inflation.

Technology consensus

Achieving consensus also reaches out into the technology arena. A new type of consensus for blockchain is a major element driving the power consumption required for validation of computational transactions.

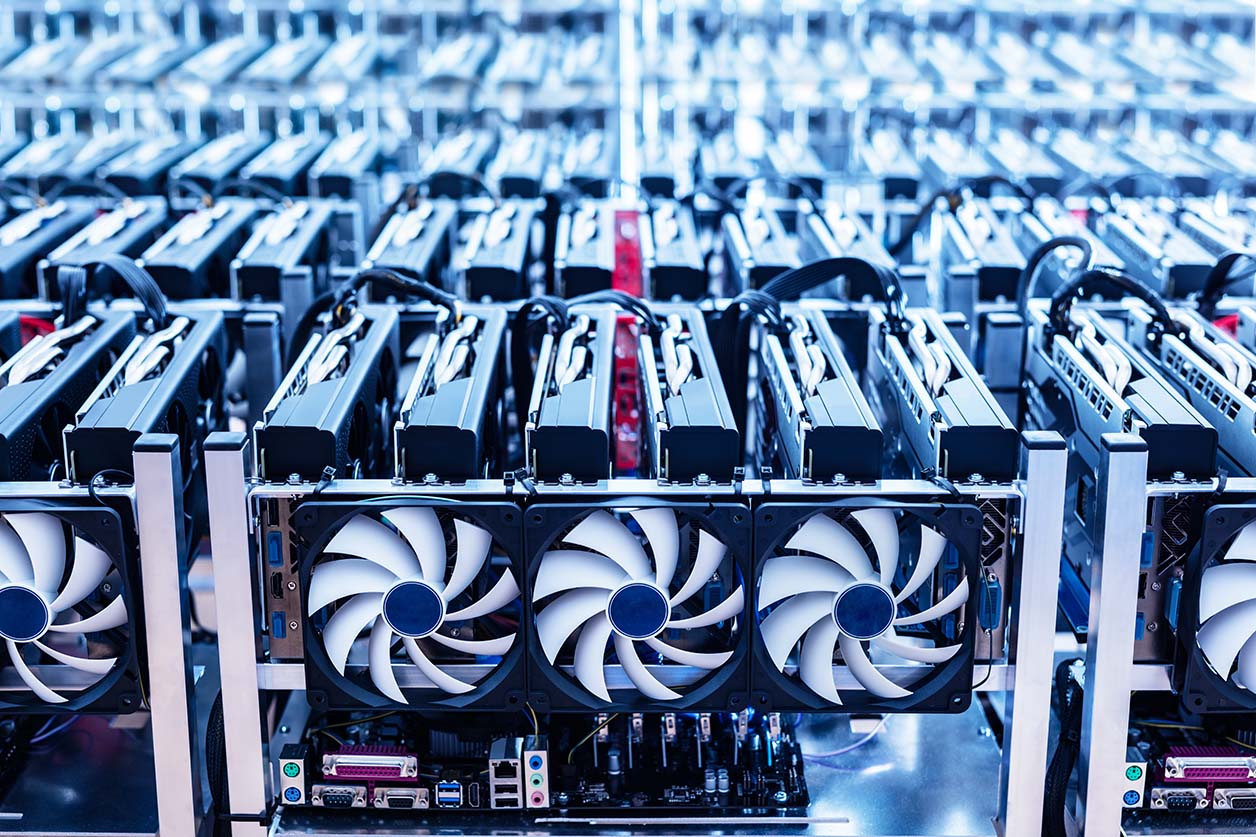

Consensus protocols form the backbone of blockchain by helping all the nodes in the network verify transactions, making sure one hacker cannot access more than 51% of the nodes and therefore gain control, vast arrays of computers are now required to be the first to validate and then earn from the process. Yet there is a growing price to pay for the tech revolution: the technology for cryptocurrencies is power-hungry, and the worry is that only way to satisfy the huge and insatiable demand is through the use of fossil fuels.

In the early days, consensus was simple, where a lone home computer could validate a transaction, consuming a negligible amount of electricity. But with multiple coins and enormous demand to earn (rewards equate to approximately 6.25 new bitcoins for guessing the hash key correctly) it is no surprise that mining remains lucrative.

Due to the scale and size of the bitcoin public ledger, distributed across many multiple network nodes, today it is estimated that 12 years of household electricity is consumed per coin mined. This staggering operational cost has fuelled demand for faster devices, more efficient processors, better cooling systems and higher pressure on electricity supplies, costs which are out of reach for individuals but only sustainable by state funding or large corporate budgets.

According to the New York Times, the process of creating bitcoin to spend or trade consumes around 91 terawatt-hours of electricity annually, more than is used by Finland, a nation of about 5.5 million. To put computational requirements into perspective, Digiconomist estimated that one bitcoin transaction generates a million times more in carbon emissions than a single credit card transaction, and that bitcoin energy requirements could equal that of all data centres globally.

It will be fascinating to see how mainstream crypto becomes, how consensus protocols which favour large server arrays will flourish and to what extent the world can satisfy its unquenchable thirst for energy.

In conclusion, adapting to change in financial markets is a must as global companies cannot rely on past performance, budget or organisational structures.

As the businesses of the world embrace digital processes, we are witnessing a number of changes. Changes to working practice, more cross-border agreements, new international entrants to support supply chains, new economic centres and mobilisation of people, as well as the continuing shift from agricultural to industrial economies.

Companies are at a critical stage as they must prepare themselves for this change, by standardising, rationalising and re-using systems and process immediately if they are to compete. They must work with consensus, collaborate and continue to adapt to a new industrial landscape – now is the time to address all of this.

About the author

For further information:

www.euroeximbank.com

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group