If it all comes tumbling down

John E. Kaye

- Published

- Banking & Finance, Home

International financial investigator Jared Bibler believes that unless vital lessons are learned from Iceland’s 2008 banking collapse, a greater financial crisis waits around the corner. To understand how the world really works, you need to understand Iceland’s Secret.

Between 2009 and 2011, I oversaw the inquiry into the shocking criminal activities behind the 2008 Iceland financial crisis. Since then, global equity markets have skyrocketed on the back of massive growth in the money supply. How long such lofty levels can be maintained is anyone’s guess.

However, one thing is certain: despite the efforts of central bankers and global regulators to learn the lessons of the wider 2007-8 global financial crisis and implement reforms, the fundamental causes remain unchanged.

That is because of two fundamentals. Firstly, the closer humans get to riches—especially those easily earned—the greater their temptation to misuse them. Secondly, the factors encouraging consolidation inherent in our system of market capitalism mean global finance is now dominated by institutions with balance sheets sometimes multiples bigger than the economies of the jurisdictions in which they are based.

Many of today’s financial actors are behemoths, even bigger and more concentrated than they were a decade ago. To take a few examples from Wall Street, in 2020, Goldman Sachs was nearly a third bigger than it was in 2008 (+31% in total assets) and both Bank of America and JP Morgan Chase are today more than half again as big (+55% and +56%, respectively) as

they were in the banner year of the global crisis. Meanwhile, the assets under management at Blackrock have increased by more than 700% on the same time period.

Sadly, experience has shown that the bigger the institution, the more the hiding places. Because financial firms themselves have grown so large and complex, when something goes wrong with a deal, there’s always somewhere to hide it so that it can remain undetected for a long time.

And there will always be transactions that go wrong and need to be hidden because of the weaknesses of human nature.

Look at Credit Suisse, the big Swiss bank, which is also a leading player on Wall Street. Earlier this year, the bank—which had supposedly learned all the lessons of the financial crisis in terms of improving compliance and risk assessment—booked an eye-popping $5.5 billion out-of-the-blue loss because of its relationship with Archegos, a hitherto obscure family office.

The latter, in fact, was a massively leveraged quasi hedge fund, which had bet vast sums on just a handful of stocks. More ominously still, its founder was a financier who had already paid a large settlement in an insider trading case. Nevertheless, the masters of the universe at Credit Suisse extended and maintained whopping credit lines (apparently at relatively modest returns for the bank), ignoring internal warnings at multiple levels.

Moreover, Credit Suisse was not alone. Some of Wall Street’s best and brightest also extended credit lines to Archegos, though most of them were more adept than the Swiss lender when it came to getting out fast. In all cases, however, there appears to have been no warning signs of an impending crisis, and certainly not with any regulator.

The biggest banks today are not even one bank: they are a nested series of companies incorporated across dozens of jurisdictions, each having its own financial books. Amazingly, it is often the case that no one person or team has a clear picture of the overall exposures of the bank. Even in 2021, there is usually no automated system one could query by counterparty, country, company—never mind CO2 level—to learn about exposures. Many banks operate a web of antiquated and irreconcilable IT systems, the products of past mergers never fully consummated. ‘Bubble gum and toothpicks’ would, in some cases, be a better analogy for the inside of big banks than ‘precision timepieces’. If not even their own employees can see the whole picture, what hope for their auditors and regulators?

Unfortunately, I speak from bitter experience. In 2007-2011, during the financial meltdown that saw the collapse of Iceland’s three biggest banks within a matter of days, I was, in stages, a bank employee, a bystander and, later, a top investigator for the small country’s financial authority. My experience taught me that, all too often, there is scant incentive (and little political will) for underpaid and understaffed bank supervisors to be aggressive in demanding relevant information.

Despite the lessons in Iceland—a cataclysm that effectively bankrupted an entire country and impoverished a population—and the broader international financial crisis, today’s global financial system remains shambolic. Its piecemeal construction makes it virtually impossible to prevent the next meltdown—or even to predict where it might originate. The banks don’t know every risk they bear—and if they don’t know, you can be sure their regulators know even less.

But aren’t financial disasters mainly a problem for bankers? Maybe, if they remain mild. But the bigger the disaster, the bigger the consequences for everybody—because our financial system isn’t just fairy-tale castles of shell companies and opaque derivatives: it is also the very same system we use to keep our economies moving. We need a payments system for trade to pay for our food, our fuel, and our housing. We need reliable ways to save and invest money. Our whole economy is built around this system. And if this system is severely threatened, it could rip asunder the very fabric of society—as it very nearly did in Iceland in 2008.

So what can be done? Fortunately, we already have all the tools we need today. What is missing is the political will. We must act decisively to break up oversized banks into smaller and more transparent entities. That can be done, for example, by indexing balance sheet size to factors in the real economy and using sustainability criteria to evaluate exposures.

We should experiment with and develop alternative systems of finance, involving crowdfunding and limited-purpose entities, and encourage community-lending and microtax solutions”. And we must better incentivize our regulators and prosecutors to examine and investigate white-collar crime. That means market-based pay and bonuses for the people we entrust to police our banks. And, finally, as the collapse of various complex jury trials has shown, we need to adjust judicial systems to cope with highly complex financial crimes.

We also require further steps on transparency to open up those remaining jurisdictions that allow companies to be registered without disclosing their beneficial owner. Moral pressure must be put on misinformation havens like the British Virgin Islands and the US State of Delaware to provide full transparency. The efforts of independent news organizations here in lifting the veil on scandals such as the Panama Papers must be encouraged.

Only through such reforms can we be more assured that the global financial system is fit for purpose. While those changes that have taken place are to be welcomed, continuing scandals in financial markets—and particularly within banks—demonstrate that it is still far too early to rest on our laurels.

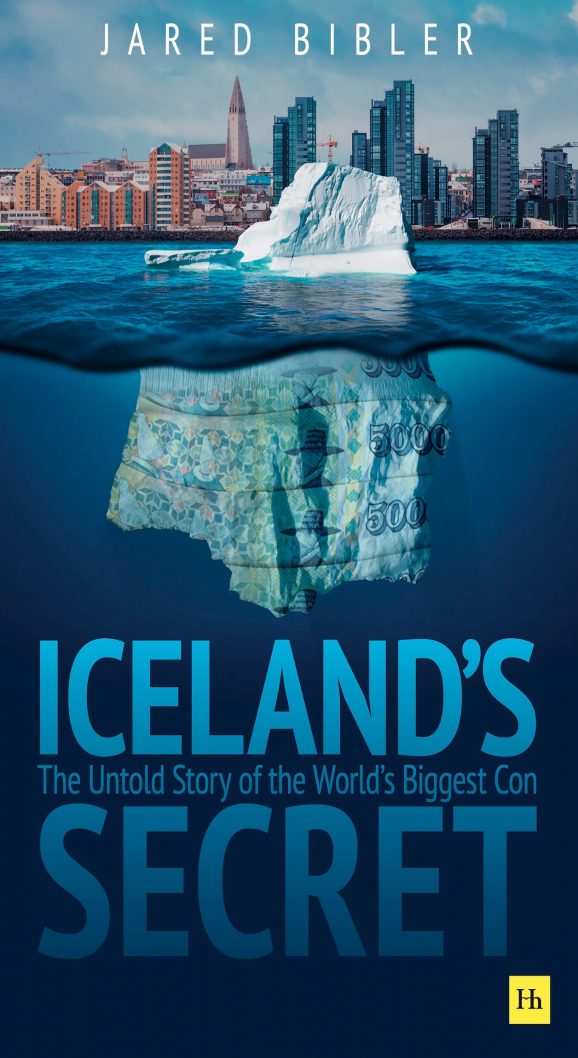

Iceland’s Secret: The Untold Story of the World’s Biggest Con (Harriman House) is out now on Amazon in hardcover, eBook, and audiobook formats, priced £22.99, £14.99, and £16 respectively. Visit www.icelandssecret.com

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group