Bond investors wait for more headlines on EU recovery fund

John E. Kaye

- Published

- News

Hopes are high that the 750 billion-euro ($851.70 billion) fund will be approved at an EU summit late next week. Intended to mostly offer grants to the countries worst hit by the coronavirus, it has been one of the main drivers of a recent drop in Southern European borrowing costs, led by Italy.

On Wednesday, European Council President Charles Michel said the EU needed to reach an agreement quickly on the fund but much negotiation was still needed.

Euro zone finance ministers will meet at 1300 GMT to select their new leader. German Chancellor Angela Merkel and Dutch Prime Minister Mark Rutte will give a joint news conference in Berlin at 1830 GMT.

“We don’t anticipate a fast agreement (little in the EU moves quickly), but would be cautious around putting too much weight on negative-sounding headlines, which are almost certain to be seen,” Mizuho analysts told clients.

“Instead, we stick to our expectation for a slow but inexorable grind towards a consensus relatively close to the Franco-German proposal,” they said, referring to a plan for 500 billion euros in grants. The EU later added 250 billion euros in loans to the plan.

On Thursday, Germany’s 10-year yield was down 1 basis point to -0.45%, close to one-week lows. Italian 10-year yields were unchanged at 1.28%.

Long-term gauges of euro zone inflation expectations fell to a week-and-a-half low at 1.10% after hitting their highest since early March and nearing 1.15% in late June. They remain above their record lows just above 0.70% in March.

The European Central Bank is prepared to get more innovative with its monetary policy tools if necessary, France’s central bank chief, a governing council member, said.

Italian banks increased their domestic government bond holdings in May, to 434.1 billion euros from 419.3 billion in April.

In the primary market, Ireland sold 1.5 billion euros of 7-, 10- and 30-year bonds in an auction, the top of the range originally announced.

Reported by Yoruk Bahceli

Sourced Reuters

For more Banking & Finance and Daily news follow The European Magazine

RECENT ARTICLES

-

Deepfake celebrity ads drive new wave of investment scams

Deepfake celebrity ads drive new wave of investment scams -

WATCH: Red Bull pilot lands plane on moving freight train in aviation first

WATCH: Red Bull pilot lands plane on moving freight train in aviation first -

Europe eyes Australia-style social media crackdown for children

Europe eyes Australia-style social media crackdown for children -

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards -

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes -

Europe opens NanoIC pilot line to design the computer chips of the 2030s

Europe opens NanoIC pilot line to design the computer chips of the 2030s -

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’ -

Gen Z set to make up 34% of global workforce by 2034, new report says

Gen Z set to make up 34% of global workforce by 2034, new report says -

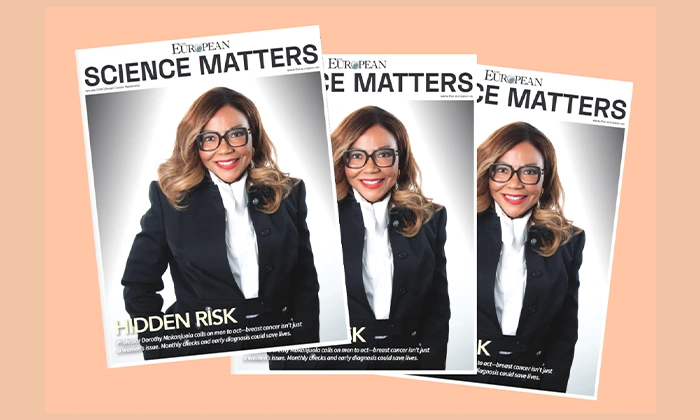

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now -

Lasers finally unlock mystery of Charles Darwin’s specimen jars

Lasers finally unlock mystery of Charles Darwin’s specimen jars -

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year -

Artemis II set to carry astronauts around the Moon for first time in 50 years

Artemis II set to carry astronauts around the Moon for first time in 50 years -

Meet the AI-powered robot that can sort, load and run your laundry on its own

Meet the AI-powered robot that can sort, load and run your laundry on its own -

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt -

Centrum Air to launch first European route with Tashkent–Frankfurt flights

Centrum Air to launch first European route with Tashkent–Frankfurt flights -

UK organisations still falling short on GDPR compliance, benchmark report finds

UK organisations still falling short on GDPR compliance, benchmark report finds -

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties -

Anniversary marks first civilian voyage to Antarctica 60 years ago

Anniversary marks first civilian voyage to Antarctica 60 years ago -

Etihad ranked world’s safest airline for 2026

Etihad ranked world’s safest airline for 2026 -

Read it here: Asset Management Matters — new supplement out now

Read it here: Asset Management Matters — new supplement out now -

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now -

The new Residence & Citizenship Planning supplement: out now

The new Residence & Citizenship Planning supplement: out now -

Prague named Europe’s top student city in new comparative study

Prague named Europe’s top student city in new comparative study -

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness