Supporting businesses across the board

John E. Kaye

- Published

- Business Travel, Home

Jersey’s history is a fascinating legacy of invention and innovation. The island’s economy has evolved from the days of the knitting industry, boat building and fishing, to success in agriculture, tourism and finance; the latter which now provides around 54% of the island’s revenue.

Today, Jersey is well positioned to build on its success as a hotbed for blue-chips and startups alike. The European caught up with John Le Fondré, Chief Minister of Jersey, to discuss what makes the island so attractive to investors.

Which factors underpin Jersey’s excellent reputation as a business destination?

John Le Fondré: Jersey has a long-standing reputation for both political and economic stability, having been a leading international finance centre for over 50 years. Combined with a strong and respected regulatory framework, the island’s success is based on the skills and expertise of the large number of professionals who work here, in no small part drawn by our beautiful environment and the benefits of island living.

Added to this ease of doing business is the excellent accessibility and connectivity, with 36 daily flights from more than 20 airports across the UK and Europe, including major European technology centres. Flight times from London can be as little as 35 minutes and a large number of people commute either to or from Jersey on a daily or weekly basis.

How important are the jurisdictions legal structures from a business perspective?

JLF: As a Crown dependency the jurisdiction has for over 800 years had the right of constitutional self-governance and judicial independence. We have a strong and very well respected legal system.

Equally important is Jersey’s strong regulatory environment, enforced by our effective and independent financial services regulator. We are at the forefront of meeting international standards, for example Jersey’s anti-money laundering regime was assessed by MONEYVAL in 2016 and scored the highest out of all states assessed, with 48 out of 49 FATF Recommendations scoring “compliant” or “largely compliant”. In 2018 Jersey introduced new data protection legislation which offers equivalent protection to the GDPR to maintain the free flow of data between Jersey and the EU.

How is Jersey embracing digital technology and what benefits will this bring?

JLF: Jersey is a full-fibre island with a world-leading, ultrafast, fibre optic broadband network. Digital Jersey is the government-backed economic development agency and industry association dedicated to the growth of the digital sector. It works to upskill the island’s workforce, create new digital jobs, help companies to increase their productivity, and develop strategies to make Jersey a world-leading base for digital innovation. As my friend Tony Moretta discusses in these pages, Digital Jersey has also set up Sandbox Jersey, which offers the island as a testbed for new digital products and services. The government continues to invest in digital. 2018 saw the launch of DJX a dedicated technology space and research centre and in September 2019 Digital Jersey will open a new Digital Skills Academy.

Outline some of the ways Jersey plans to maintain its appeal to investors.

JLF: Jersey is rated as one of the most successful international finance centres in the world and has flourished in the long-term by ensuring we remain a well-regulated centre that meets international standards – we will continue to do so. While maintaining this strength, we are supporting other growth markets such as digital.

We will be increasing our promotional reach to the United States through the opening of Jersey Finance’s new office in New York. This will build on the existing Jersey Finance offices in Dubai and Hong Kong. These, alongside our government offices in London, Brussels and Normandy, continue to promote Jersey as a place to invest in and do business, supported by products that are new to Jersey such as the Jersey International Savings Plan and Limited Liability Companies.

Further information

RECENT ARTICLES

-

Air India and Lufthansa expand codeshare to nearly 100 routes across Europe and India

Air India and Lufthansa expand codeshare to nearly 100 routes across Europe and India -

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards -

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt -

Royal Ascot leads the field in sport and style

Royal Ascot leads the field in sport and style -

Slovenia launches digital nomad visa for non-EU remote workers

Slovenia launches digital nomad visa for non-EU remote workers -

Charting confidence at sea with the St. Kitts & Nevis Ship Registry

Charting confidence at sea with the St. Kitts & Nevis Ship Registry -

Luxury travel market set to more than double by 2035 as older, wealthier travellers drive demand

Luxury travel market set to more than double by 2035 as older, wealthier travellers drive demand -

Countdown to Davos 2026 as Switzerland gears up for the most heated talks in years

Countdown to Davos 2026 as Switzerland gears up for the most heated talks in years -

Prague positions itself as Central Europe’s rising MICE powerhouse

Prague positions itself as Central Europe’s rising MICE powerhouse -

Bleisure boom turning Gen Z work travel into ‘life upgrade’

Bleisure boom turning Gen Z work travel into ‘life upgrade’ -

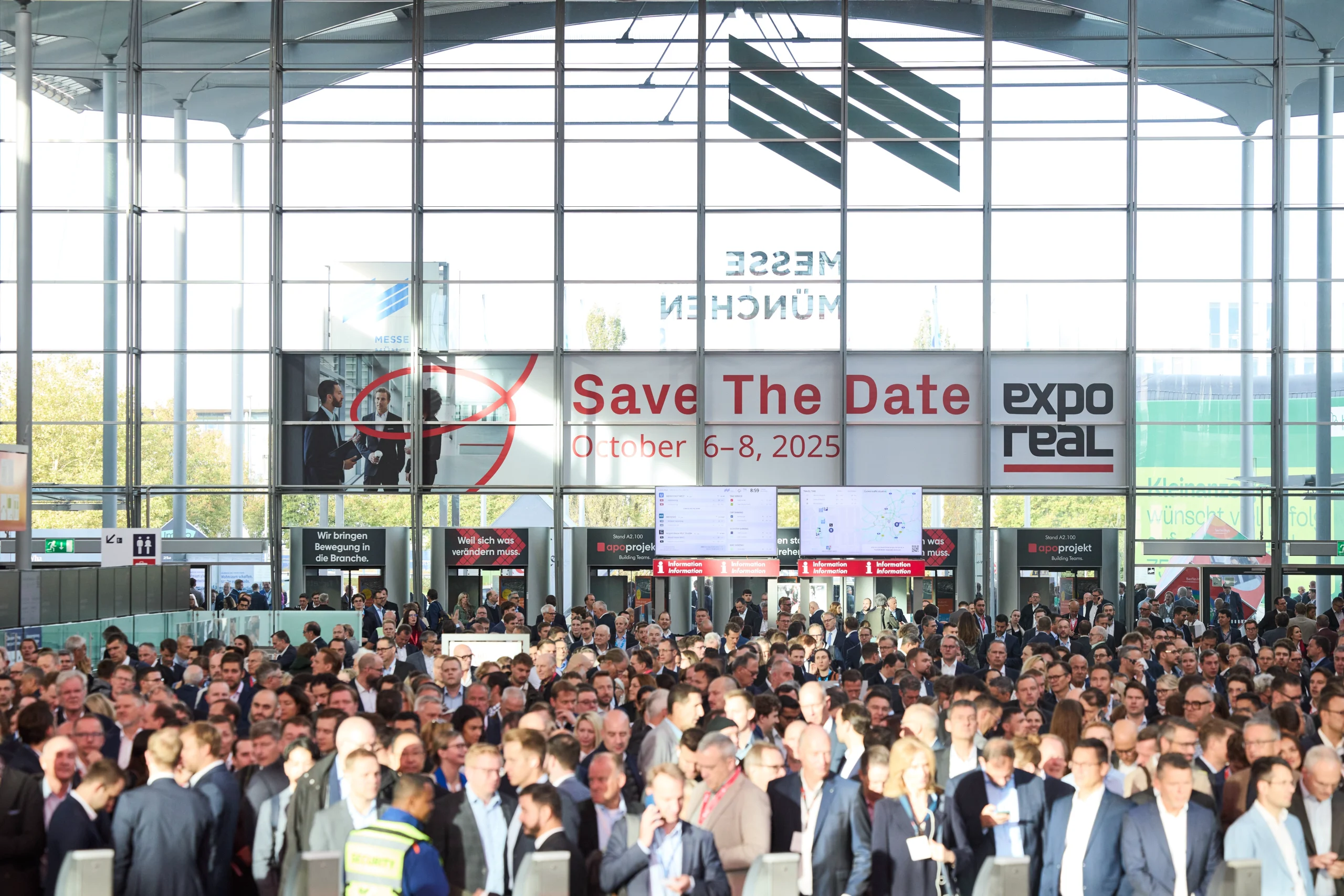

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain -

Inside London’s £1bn super-hotel with £20k penthouses, private butlers and a gilded eagle

Inside London’s £1bn super-hotel with £20k penthouses, private butlers and a gilded eagle -

The five superyacht shows that matter most

The five superyacht shows that matter most -

A world in gold: Andersen Genève launches the Communication 45

A world in gold: Andersen Genève launches the Communication 45 -

Uber plots Channel Tunnel disruption with app-bookable high-speed trains

Uber plots Channel Tunnel disruption with app-bookable high-speed trains -

Game, set...wax. Billie Jean King statue unveiled in New York

Game, set...wax. Billie Jean King statue unveiled in New York -

How a tiny Black Forest village became a global watchmaking powerhouse

How a tiny Black Forest village became a global watchmaking powerhouse -

Memories of Tehran, a city of contrasts

Memories of Tehran, a city of contrasts -

Addiction rehab and recovery at Hope Thailand

Addiction rehab and recovery at Hope Thailand -

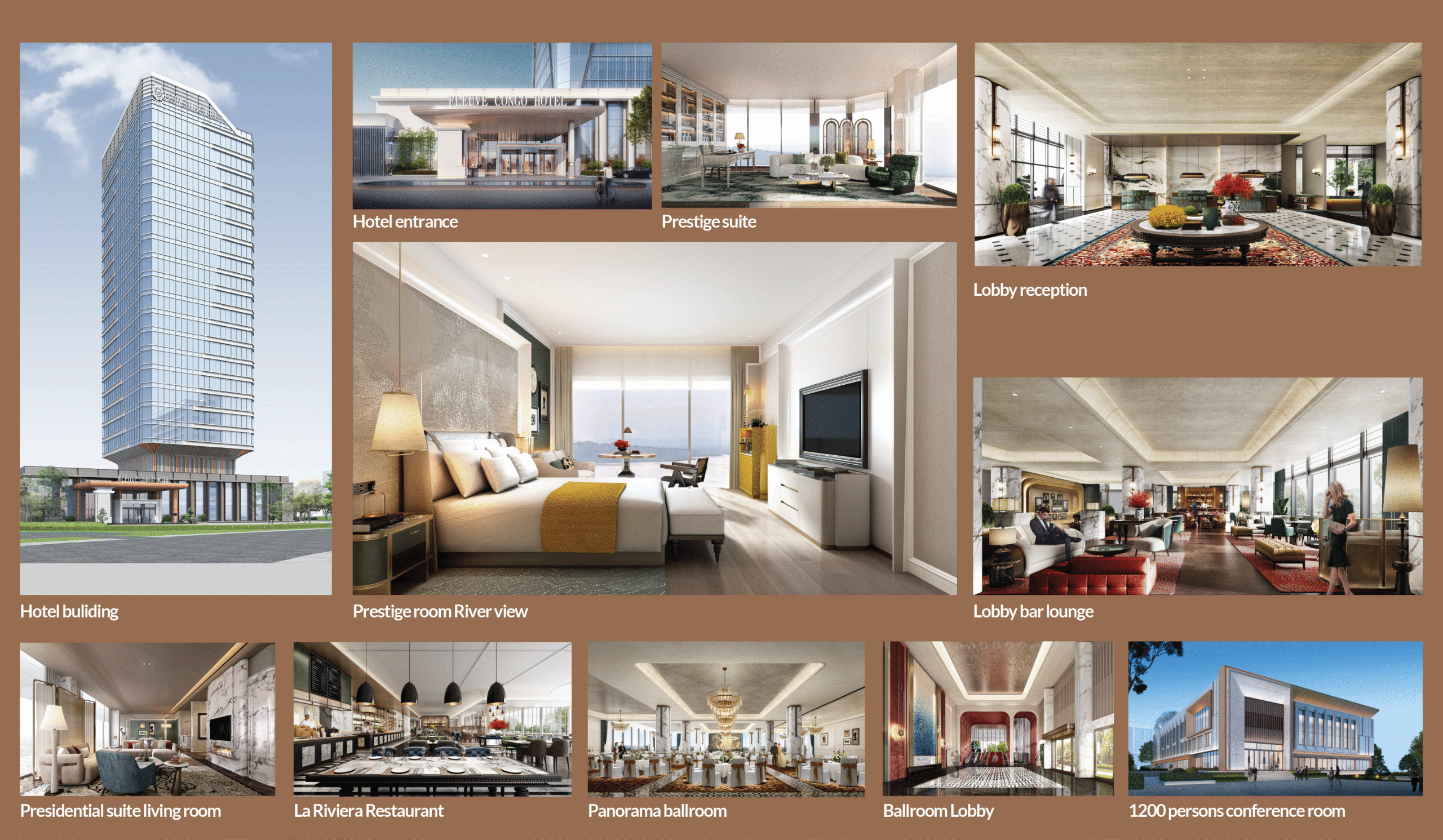

Capital gains: inside Kinshasa’s flagship five-star hotel

Capital gains: inside Kinshasa’s flagship five-star hotel -

This under-the-radar spot is Europe’s best late summer escape

This under-the-radar spot is Europe’s best late summer escape -

Why Madeira is Europe’s ultimate island retreat

Why Madeira is Europe’s ultimate island retreat -

Three resorts, three generations, and one extraordinary family legacy

Three resorts, three generations, and one extraordinary family legacy -

Wellness with a view at Cape of Senses

Wellness with a view at Cape of Senses -

Travel across five European countries by train in under one day

Travel across five European countries by train in under one day