The smart way to structure family wealth: Why Liechtenstein funds are in demand

John E. Kaye

- Published

- Banking & Finance, Liechtenstein

Funds are increasingly being used by families and family offices as efficient, flexible vehicles for long-term wealth structuring. Here, David Gamper, Managing Director of the Liechtenstein Investment Funds Association, explains why demand remains strong, and why Liechtenstein continues to stand out as a fund domicile

The demand for customised investment funds as instruments for structuring family wealth remains strong. This is largely due to the many advantages they offer, from administrative simplicity to international tax efficiency.

By outsourcing the administration of family assets, including accounting, performance calculation and reporting, to a fund management company, clients benefit from lower costs and consolidated global oversight. Appointing multiple asset managers across different jurisdictions remains possible, and there are no limitations on asset classes.

Working with a fund management company also provides access to specialist knowledge throughout the entire value chain, from initial structuring and regulatory setup to day-to-day operational support.

Investor protection is another key advantage. Funds, their administrators, and custodian banks are strictly regulated in the European Union. This ensures compliance with governance and transparency standards, and legally obliges fund management companies to act in the interests of investors — which, in the case of family funds, means the individual family members themselves.

PULL QUOTE: “The Principality itself continues to enhance its reputation as a trusted location for white label fund management, particularly in the area of family wealth.”

This applies equally in Liechtenstein, a member of the European Economic Area (EEA) and a recognised fund domicile within the EU regulatory framework. Liechtenstein funds and their managers are subject to regular audits by specially authorised firms and are supervised by the Liechtenstein Financial Market Authority (FMA). The FMA, in turn, is a full member of the European Securities and Markets Authority (ESMA), holding equal rights and responsibilities to any EU national regulator.

White label funds also offer tax advantages. They can be tailored to reflect the tax position of individual family members in their respective countries of residence. As a recognised investment vehicle, the fund’s income is taxed at the investor’s domicile, which simplifies matters for families with cross-border tax exposure. In Liechtenstein, funds are exempt from all taxes, meaning there is no additional taxation at the fund level.

Structurally, funds also offer high flexibility. They can be created in various legal forms, and in Liechtenstein, investment companies can issue different share classes with or without voting rights, allowing asset controllers to designate how control is distributed among family members. Funds can also be used in succession planning; for example, a family business can be placed in a fund, with units distributed to heirs efficiently and typically at low cost.

Liechtenstein’s alternative investment fund (AIF) regime imposes no statutory diversification requirements, which means individual investments, such as a single company, can be included without restriction. This makes AIFs an attractive tool for bespoke wealth structuring.

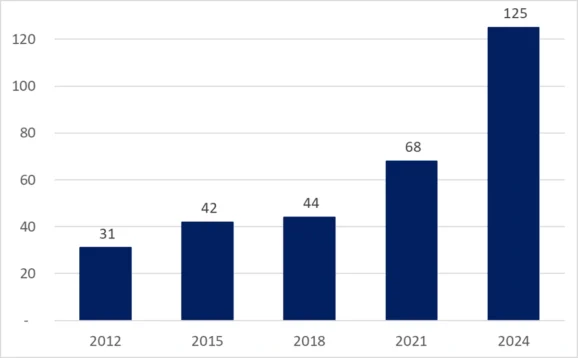

The Principality itself continues to enhance its reputation as a trusted location for white label fund management, particularly in the area of family wealth. Assets under management have increased significantly in recent years, supported by the country’s political and economic stability. The Principality is one of the few countries in the world with no public debt, and its currency, the Swiss franc, is considered among the safest globally, thanks to a longstanding monetary union with Switzerland. It is also one of only 11 countries worldwide to hold a coveted AAA rating from Standard & Poor’s.

Further information

This sponsored article was written by David Gamper and published in partnership with Liechtenstein Investment Funds Association. For further information visit www.lafv.li/en/

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

J.P. Morgan launches first tokenised money market fund on public blockchain

J.P. Morgan launches first tokenised money market fund on public blockchain -

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS

Aberdeen agrees to take over management of £1.5bn in closed-end funds from MFS -

Enterprise asset management market forecast to more than double by 2035

Enterprise asset management market forecast to more than double by 2035 -

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards

EU Chamber records highest number of entries for 2025 China Sustainable Business Awards -

Inside Liechtenstein’s strategy for a tighter, more demanding financial era

Inside Liechtenstein’s strategy for a tighter, more demanding financial era -

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre

‘Stability, scale and strategy’: Christoph Reich on Liechtenstein’s evolving financial centre -

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era

Bridging tradition and transformation: Brigitte Haas on leading Liechtenstein into a new era -

Liechtenstein in the Spotlight

Liechtenstein in the Spotlight -

Fiduciary responsibility in the balance between stability and global dynamics

Fiduciary responsibility in the balance between stability and global dynamics -

Neue Bank’s CEO on stability, discipline and long-term private banking

Neue Bank’s CEO on stability, discipline and long-term private banking -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt

Philipp Kieber on legacy, leadership and continuity at Interadvice Anstalt -

Building global-ready funds: how South African managers are scaling through offshore platforms

Building global-ready funds: how South African managers are scaling through offshore platforms -

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds

Global billionaire wealth hits record as relocation and inheritance accelerate, UBS finds -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group