Creating true sustainability

John E. Kaye

- Published

- Asset Management, Banking & Finance

ESG Portfolio Management GmbH is a multi-award-winning specialised investment firm that focuses on sustainable funds and mandates. With a strong commitment to environmental, social, and governance (ESG) principles, the company aims to create a positive impact while delivering financial returns

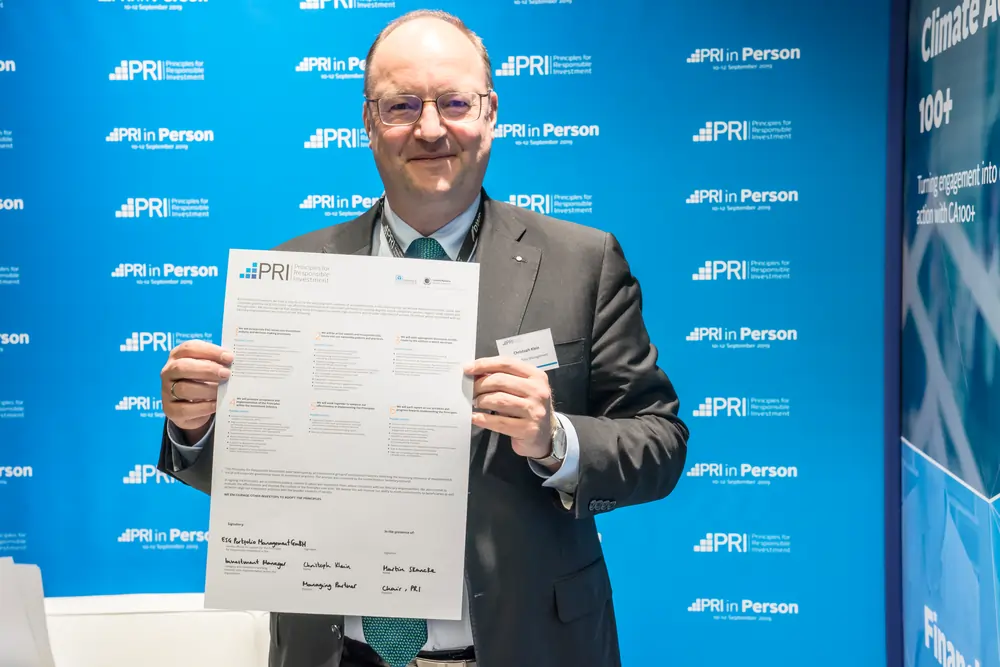

Christoph M. Klein, CFA, CEFA, is founder and managing partner at ESG Portfolio Management an award-winning boutique for sustainable investments.

He serves as a member of the CFA ESG Technical Committee and the DVFA Sustainable Investing Commission. He is also an instructor for ESG and climate risk seminars for Moody’s.

The European caught up with Christoph to find out more.

You are familiar with the entire sustainable investment sector. Would you say that your SDG Evolution Flexibel fund stands out in terms of portfolio selection and transparency?

Christoph Klein: Sustainable investing and transparent reporting are an integral part of our work.

In recent years, we have seen a growing interest in sustainable investment products, which has now also led to increased regulatory measures to promote transparency and accountability. However, sustainability has become a very broad term and many investors find it difficult to distinguish genuine sustainable investments from those that only appear to be sustainable. For this reason, our selection and evaluation process of individual positions is based on 7 criteria that we strictly adhere to in order to create true sustainability in our portfolio.

All our positions are selected and regularly reviewed based on the following criteria:

- A detailed list of exclusion criteria

- The ESG qualities and ratings

- The Sustainable Development Goals

- The amount of CO2 caused by the position

- High alignment with the EU taxonomy, the classification system for environmentally sustainable business practices

- Compliance with Art. 2 No. 17 of the Sustainable Financial Disclosure Regulation (SFDR), which provides the definitional basis for sustainable investments

- The Principle Adverse Indicators (PAIs), i.e. the negative impact of investment decisions

We report on these criteria in our monthly report in order to offer our investors and new investors the best possible transparency.

How do you manage to present your investment behaviour and selection efforts transparently to your investors and potential new investors?

CK: Transparency towards investors and potential new investors is a central element of our actions. We attach great importance to communicating our investment decisions and selection processes clearly and comprehensibly. The monthly report that we publish on our website – a kind of newsletter that we publish every month on our website and on LinkedIn on the second working day – plays a central role for us. In it, we address current topics from the world of sustainable finance and report on the performance of our fund and investments in the individual dimensions. In addition to financial performance, our monthly report includes the development of the cumulative ESG qualities, the Sustainable Development Goals and the CO2 emissions of the positions in our portfolio. At the end of each quarter, we show how well our portfolio complies with the EU taxonomy, what percentage of our positions are sustainable within the meaning of Article 2 No. 17 of the Sustainable Financial Disclosure Regulation (SFDR), and how our portfolio performs in relation to the 14 PAIs, i.e. the negative impact of investment decisions. We present our reports in a compact form so that every investor and potential new investor can access the necessary data quickly and easily and understand it immediately.

Every active trader knows that, contrary to what the general public believes, the shares of companies in the renewable energy sector have suffered greatly in recent years. This has also affected your fund somewhat. How do you see yourself prepared for the coming years?

CK: Companies must also be financially sustainable. That’s why we prefer companies with positive free cash flows. We diversify across sectors and regions. This is also an essential part of our risk management. Unfortunately, our thesis that sustainable companies should also offer good financial performance has not worked out in recent years. Companies in the renewable energy sector have suffered from high commodity costs, rising interest rates, and margin pressure – partly from unfair price dumping from China but also from political risks and often overcomplicated regulation, which has harmed demand and profits. We maintain that renewable energies are necessary to mitigate climate change.

We invite everyone to invest in our fund to support our mission of creating true sustainability. There is no minimum investment hurdle.

Further information

esg-portfolio-management.com

Sign up to The European Newsletter

RECENT ARTICLES

-

Lusaka Securities Exchange surges ahead on reform momentum

Lusaka Securities Exchange surges ahead on reform momentum -

PROMEA leads with ESG, technology and trust in a changing Swiss market

PROMEA leads with ESG, technology and trust in a changing Swiss market -

Why collective action matters for pensions and the planet

Why collective action matters for pensions and the planet -

Structuring success with Moore Stephens Jersey

Structuring success with Moore Stephens Jersey -

PIM Capital sets new standards in cross-jurisdiction fund solutions

PIM Capital sets new standards in cross-jurisdiction fund solutions -

Innovation, advisory and growth: Banchile Inversiones in 2024

Innovation, advisory and growth: Banchile Inversiones in 2024 -

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership

Digitalization, financial inclusion, and a new era of banking services: Uzbekistan’s road to WTO membership -

Fermi America secures $350m in financing led by Macquarie Group

Fermi America secures $350m in financing led by Macquarie Group -

Banchile Inversiones receives three prestigious international awards

Banchile Inversiones receives three prestigious international awards -

What makes this small island one of the world’s most respected financial hubs?

What makes this small island one of the world’s most respected financial hubs? -

MauBank wins international award for tackling barriers to finance

MauBank wins international award for tackling barriers to finance -

‘It’s like a private bank but with retail rates’: Inside Jersey’s mortgage market for new high-value residents

‘It’s like a private bank but with retail rates’: Inside Jersey’s mortgage market for new high-value residents -

How one fintech is using AI to fix Latin America’s broken mortgage system

How one fintech is using AI to fix Latin America’s broken mortgage system -

Why the humble trading journal could be your edge in volatile markets

Why the humble trading journal could be your edge in volatile markets -

The smart way to structure family wealth: Why Liechtenstein funds are in demand

The smart way to structure family wealth: Why Liechtenstein funds are in demand -

How market concentration is creating new risks and opportunities

How market concentration is creating new risks and opportunities -

Staying the course in an unpredictable market

Staying the course in an unpredictable market -

Decision-making factors when establishing a foundation

Decision-making factors when establishing a foundation -

Why the British Virgin Islands remains a top destination for global business

Why the British Virgin Islands remains a top destination for global business -

Malta’s growing appeal as a financial services domicile

Malta’s growing appeal as a financial services domicile -

Matthieu André on AXA IM Select’s award-winning approach to multi-manager investing

Matthieu André on AXA IM Select’s award-winning approach to multi-manager investing -

A legacy built on trust

A legacy built on trust -

U.S voters slam economy as ‘on wrong track’ — but back skills revolution, poll finds

U.S voters slam economy as ‘on wrong track’ — but back skills revolution, poll finds -

Liechtenstein financial centre: A safe haven in uncertain times

Liechtenstein financial centre: A safe haven in uncertain times -

Why biotech incubators need our support

Why biotech incubators need our support