Housing expert calls for bold EU fund to unlock cheaper homes

John E. Kaye

- Published

- Real Estate

ESCP professor Jaime Luque is urging Brussels to create a European Affordable Housing Investment Fund, arguing in a new expert report that Europe’s vast savings pool can be unlocked through smarter financial architecture, targeted public guarantees and municipal investment tools to anchor long-term affordability across the bloc

A member of the European Commission’s Housing Advisory Board has called for the creation of a dedicated European Affordable Housing Investment Fund as one of several financial measures intended to support the bloc’s forthcoming Affordable Housing Plan.

The proposal comes from Professor Jaime Luque of ESCP Business School, who contributed to the funding chapter of Towards a European Affordable Housing Plan, a new report produced by an independent panel of housing and finance experts advising the Commission.

The document sets out 75 policy recommendations aimed at guiding European-level action on affordability, capital mobilisation and long-term housing stability.

Professor Luque’s section of the report focuses on strengthening the financial infrastructure behind affordable housing delivery. Among the measures proposed are a pan-European investment fund to channel institutional and household savings into housing, preferential collateral treatment at the European Central Bank for affordable-housing-related securities, and the use of Tax Increment Financing (TIF) to allow municipalities to inject equity into new development.

“The European Affordable Housing Investment Fund would act as a pan-European vehicle to channel institutional and household savings into affordable homes,” Professor Luque told us. “Europeans hold €33 trillion in savings — half of it outside Europe. We now have an extraordinary opportunity to attract part of this patient capital to expand our stock of affordable housing across the continent. By combining public guarantees with private capital, we can make affordability a permanent feature of our housing system, not a temporary policy.”

The report also sets out proposals for the ECB to support housing-market stability through monetary-policy innovation, and for cities to create TIF districts so that a portion of future property-tax revenues can be reinvested in affordable housing.

Professor Luque said the recommendations were intended to help reframe housing as essential social infrastructure. “For too long, housing has been treated as a financial asset rather than a cornerstone of social stability,” he added. “This report sets the groundwork for a new European approach, one that combines financial innovation with social purpose.”

The European Commission is expected to draw on the report’s findings as it finalises its Affordable Housing Plan later this year.

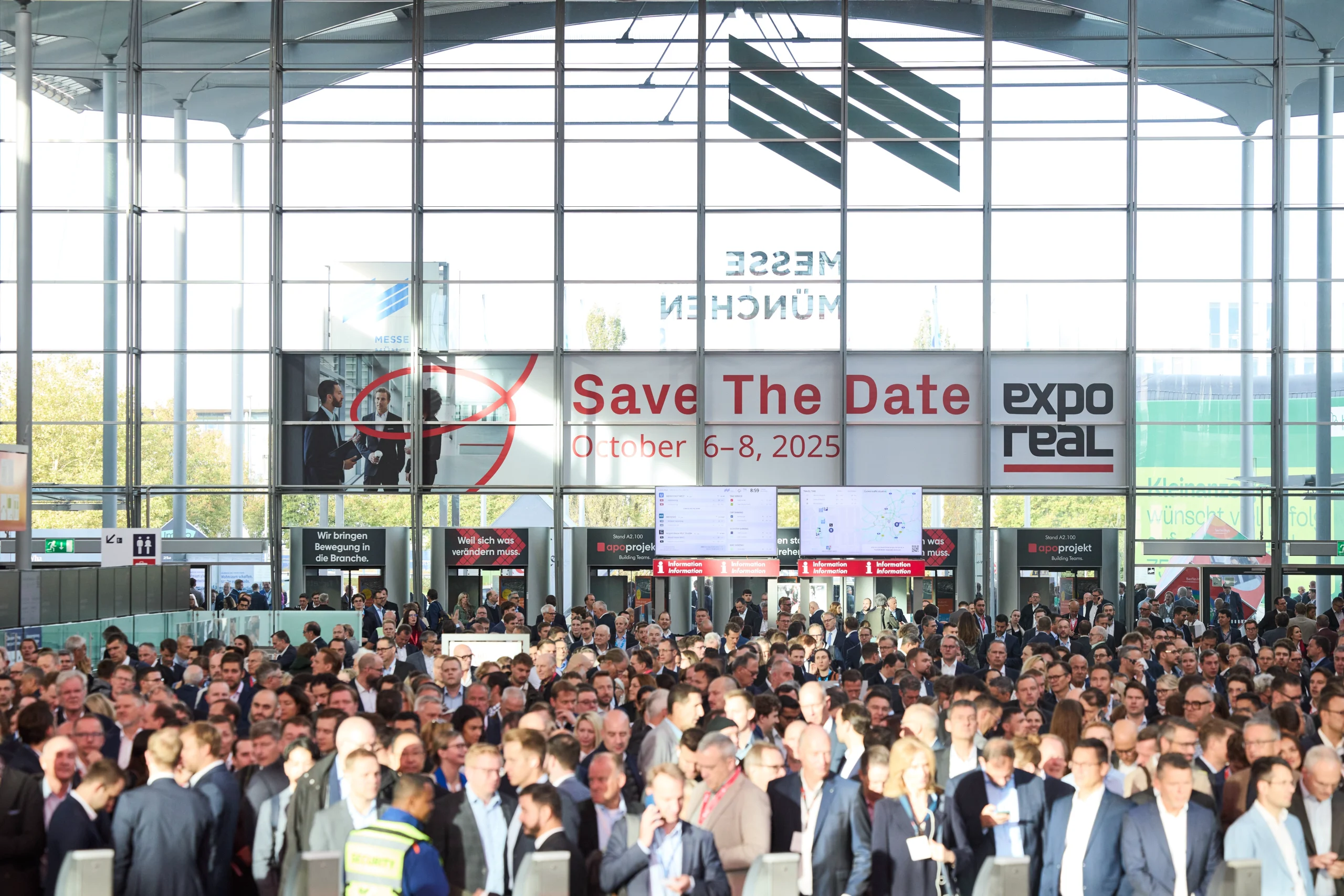

READ MORE: ‘Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain‘. A survey of nearly 600 industry leaders shows housing, care facilities and data centres driving renewed confidence in European real estate. But interest rate policy, capital constraints and bureaucratic delays remain the sector’s chief concerns ahead of Munich’s flagship property fair.

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Professor Jaime Luque, whose recommendations on financial architecture and investment tools appear in the European Commission’s new affordable housing report. Credit: Emma Fréry

RECENT ARTICLES

-

Meet Abbas Sajwani: the young founder redefining luxury real estate in Dubai

Meet Abbas Sajwani: the young founder redefining luxury real estate in Dubai -

Marriott strengthens South African portfolio with new Autograph Collection hotel in Cape Town

Marriott strengthens South African portfolio with new Autograph Collection hotel in Cape Town -

JPMorgan plans multibillion-pound tower in Canary Wharf

JPMorgan plans multibillion-pound tower in Canary Wharf -

Housing expert calls for bold EU fund to unlock cheaper homes

Housing expert calls for bold EU fund to unlock cheaper homes -

Saudis pitch trillion-dollar property boom to global investors

Saudis pitch trillion-dollar property boom to global investors -

KAPPE and Limehome back sustainable living in Braunschweig’s new business hub

KAPPE and Limehome back sustainable living in Braunschweig’s new business hub -

Dar Global unveils $1bn Trump Plaza Jeddah in second Saudi venture with Trump Organization

Dar Global unveils $1bn Trump Plaza Jeddah in second Saudi venture with Trump Organization -

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain -

Investors eye UAE as Belt and Road real estate gateway for Asia

Investors eye UAE as Belt and Road real estate gateway for Asia -

Mitsubishi Estate’s £800m South Bank scheme to deliver 4,000 jobs

Mitsubishi Estate’s £800m South Bank scheme to deliver 4,000 jobs -

AHS Properties bets on boutique exclusivity as Dubai’s luxury market booms

AHS Properties bets on boutique exclusivity as Dubai’s luxury market booms -

Finland’s property market rebounds as foreign investors return

Finland’s property market rebounds as foreign investors return -

Al Khozama turns to Yardi to manage Riyadh’s landmark Al Faisaliah Tower

Al Khozama turns to Yardi to manage Riyadh’s landmark Al Faisaliah Tower -

The four developers shaping Dubai’s skyline

The four developers shaping Dubai’s skyline -

Abu Dhabi asserts leadership in regional property market as IREIS 2025 prepares to welcome 2,000 investors

Abu Dhabi asserts leadership in regional property market as IREIS 2025 prepares to welcome 2,000 investors -

Golden opportunity: Europe needs to reclaim its lead in the global talent race

Golden opportunity: Europe needs to reclaim its lead in the global talent race -

Global Property Expo opens in Singapore next week as Asia’s influence in international real estate grows

Global Property Expo opens in Singapore next week as Asia’s influence in international real estate grows -

Engel & Völkers Snell Real Estate and Vanessa Fukunaga receive dual honours

Engel & Völkers Snell Real Estate and Vanessa Fukunaga receive dual honours -

Investor attention turns to Klīversala as exclusive Blue Marine development breaks ground

Investor attention turns to Klīversala as exclusive Blue Marine development breaks ground -

Greece’s TITAN Group climbs TIME’s global sustainability rankings

Greece’s TITAN Group climbs TIME’s global sustainability rankings -

Why Europe is turning its attention to Los Cabos, Mexico

Why Europe is turning its attention to Los Cabos, Mexico -

Cascaia, Vista Land’s Spanish-inspired estate, celebrates San Fernando’s lantern heritage

Cascaia, Vista Land’s Spanish-inspired estate, celebrates San Fernando’s lantern heritage -

Clarins heiress lists £6 million Notting Hill townhouse

Clarins heiress lists £6 million Notting Hill townhouse -

DoorBird is redefining industry standards with new products

DoorBird is redefining industry standards with new products -

Benefits of aluminium windows and doors in Built to Rent properties

Benefits of aluminium windows and doors in Built to Rent properties