Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain

John E. Kaye

- Published

- MICE, Real Estate

A survey of nearly 600 industry leaders shows housing, care facilities and data centres driving renewed confidence in European real estate. But interest rate policy, capital constraints and bureaucratic delays remain the sector’s chief concerns ahead of Munich’s flagship property fair

Confidence is returning to the property market after two difficult years, according to new research released ahead of EXPO REAL in Munich next month.

The latest Trend Index, based on a survey of 579 exhibitors and visitors to Europe’s largest real estate and investment fair, suggests that sentiment is stabilising, with confidence outweighing caution for the first time since 2022. Some 44 per cent of respondents said they were optimistic about the outlook, compared with 35 per cent who were neutral and 22 per cent who described themselves as cautious.

Housing remains the leading asset class, cited by 75 per cent of respondents compared with 70 per cent in 2024. Care properties followed with 66 per cent (2024: 67 per cent), with data centres rising to 63 per cent (2024: 61 per cent) and logistics at 47 per cent. By contrast, more traditional segments such as hospitality, office and retail drew little support, each receiving just over 10 per cent.

Respondents see the strongest growth potential in prime sites in smaller cities, followed by non-core locations in leading hubs and prime addresses in major urban centres.

Investor appetite remains concentrated in mainstream sources of capital, with asset management companies and funds identified as the most important groups by 87 per cent of respondents.

Institutional investors, family offices and private equity followed closely on 83 per cent each, underlining the sector’s continued reliance on established pools of long-term money rather than experimental financing.

Innovative approaches such as online crowdfunding remain marginal, backed by just 27 per cent.

Europe continues to dominate in geographical terms, attracting 80 per cent of respondents compared with 81 per cent last year. Asia-Pacific has moved into second place on 64 per cent, overtaking the US, which fell sharply to 45 per cent from 66 per cent in 2024. Within Europe, Western Europe led on 84 per cent, ahead of both the D-A-CH bloc and Northern Europe, each on 79 per cent.

The survey was carried out in September by the independent research institute IfaD, which was commissioned by EXPO REAL organiser, Messe München.

“The current trend index shows that we have reached the bottom and confidence is gradually returning,” its chief executive Stefan Rummel told The European.

“While the weakening economy, interest rates, political factors and bureaucracy remain key challenges, the overall balanced sentiment indicates a market slowly returning to normal. This shift is encouraging, especially for EXPO REAL, which promotes international dialogue and solution seeking in the industry.”

But despite the improved outlook, the survey highlights significant obstacles still facing the sector.

Interest rate policy and political conditions were cited as the most pressing influences by 94 per cent of respondents. The broader economy and bureaucracy followed with 90 per cent, with capital availability close behind at 89 per cent. Nearly four-in-five called for less bureaucracy, 64 per cent demanded better access to capital, 47 per cent stressed the need for standardised legal frameworks in Germany and 43 per cent prioritised the transformation of existing properties — though at a clear distance from the top demands.

The creation of housing remains a core issue for both policymakers and industry. Improved financing conditions were named by 95 per cent as the most effective lever, followed by a significant reduction in construction costs with 94 per cent. Building on existing properties ranked third at 91 per cent, ahead of eliminating expensive standards (87 per cent) and modular or serial construction (86 per cent).

Responses also suggest that confidence in government action is limited. In Germany, only 13 per cent of respondents rated the new “construction turbo” programme positively, while 27 per cent deemed it unsatisfactory or inadequate.

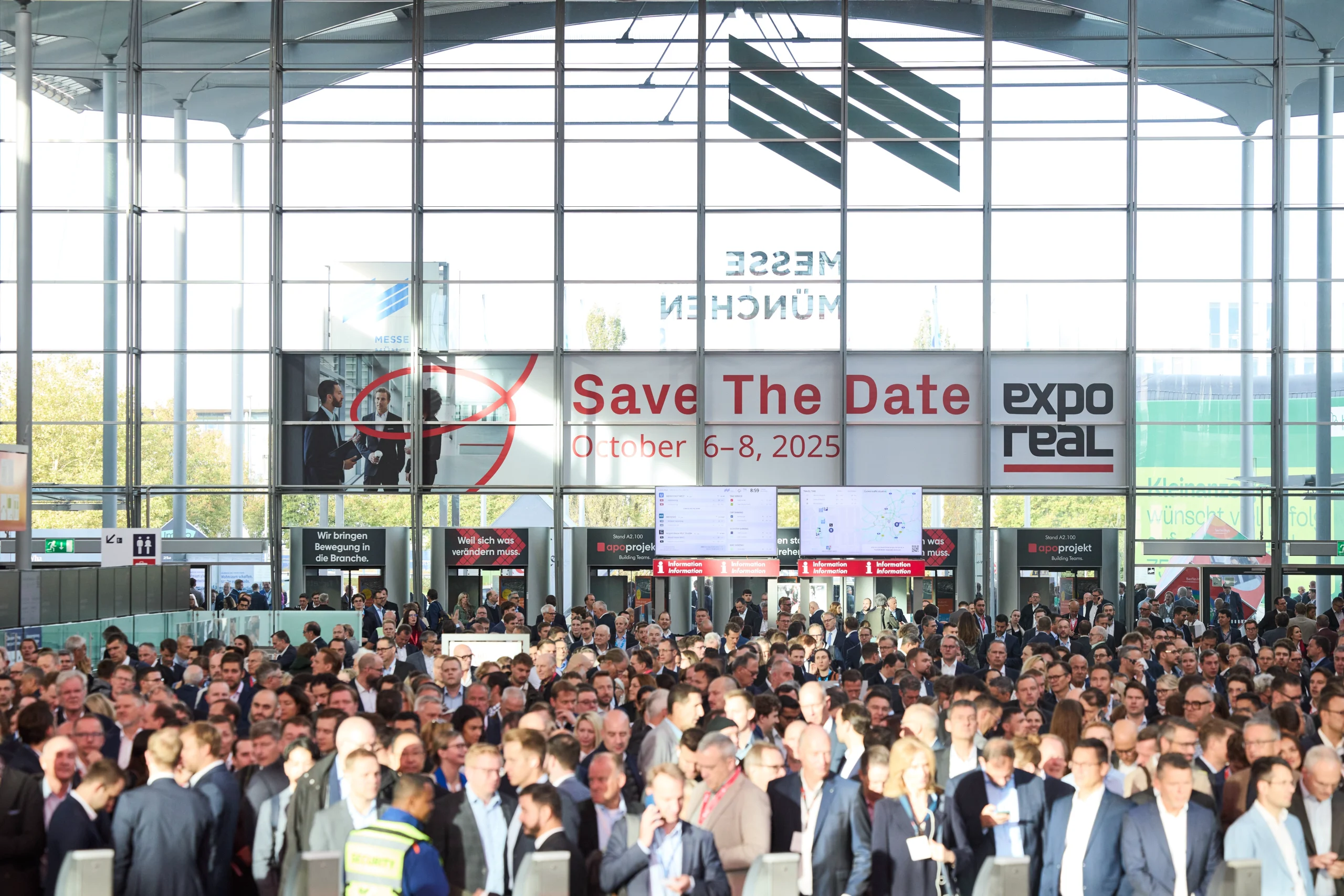

EXPO REAL, which runs from 6–8 October, will focus heavily on affordable housing, with senior political figures taking part in the debate.

Mona Keijzer, Deputy Prime Minister and Minister for Housing and Spatial Planning of the Netherlands, and Eamon Ryan, chair of the European Commission’s new Housing Advisory Board, will join panel discussions on the subject.

Germany’s new Federal Minister for Housing, Urban Development and Building, Verena Hubertz, is also scheduled to attend.

READ MORE: ‘Investors eye UAE as Belt and Road real estate gateway for Asia‘. Chinese investors are pouring record sums into UAE property, with Abu Dhabi and Dubai emerging as key Belt and Road hubs, according to new figures released at a Shanghai forum

Do you have news to share or expertise to contribute? The European welcomes insights from business leaders and sector specialists. Get in touch with our editorial team to find out more.

Main image: Tens of thousands of delegates are expected to attend EXPO REAL 2025, Europe’s largest property and investment fair. Credit: Messe München

RECENT ARTICLES

-

Meet Abbas Sajwani: the young founder redefining luxury real estate in Dubai

Meet Abbas Sajwani: the young founder redefining luxury real estate in Dubai -

Marriott strengthens South African portfolio with new Autograph Collection hotel in Cape Town

Marriott strengthens South African portfolio with new Autograph Collection hotel in Cape Town -

JPMorgan plans multibillion-pound tower in Canary Wharf

JPMorgan plans multibillion-pound tower in Canary Wharf -

Housing expert calls for bold EU fund to unlock cheaper homes

Housing expert calls for bold EU fund to unlock cheaper homes -

Saudis pitch trillion-dollar property boom to global investors

Saudis pitch trillion-dollar property boom to global investors -

KAPPE and Limehome back sustainable living in Braunschweig’s new business hub

KAPPE and Limehome back sustainable living in Braunschweig’s new business hub -

Dar Global unveils $1bn Trump Plaza Jeddah in second Saudi venture with Trump Organization

Dar Global unveils $1bn Trump Plaza Jeddah in second Saudi venture with Trump Organization -

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain

Europe’s property market shows fragile recovery as EXPO REAL survey highlights housing demand and policy strain -

Investors eye UAE as Belt and Road real estate gateway for Asia

Investors eye UAE as Belt and Road real estate gateway for Asia -

Mitsubishi Estate’s £800m South Bank scheme to deliver 4,000 jobs

Mitsubishi Estate’s £800m South Bank scheme to deliver 4,000 jobs -

AHS Properties bets on boutique exclusivity as Dubai’s luxury market booms

AHS Properties bets on boutique exclusivity as Dubai’s luxury market booms -

Finland’s property market rebounds as foreign investors return

Finland’s property market rebounds as foreign investors return -

Al Khozama turns to Yardi to manage Riyadh’s landmark Al Faisaliah Tower

Al Khozama turns to Yardi to manage Riyadh’s landmark Al Faisaliah Tower -

The four developers shaping Dubai’s skyline

The four developers shaping Dubai’s skyline -

Abu Dhabi asserts leadership in regional property market as IREIS 2025 prepares to welcome 2,000 investors

Abu Dhabi asserts leadership in regional property market as IREIS 2025 prepares to welcome 2,000 investors -

Golden opportunity: Europe needs to reclaim its lead in the global talent race

Golden opportunity: Europe needs to reclaim its lead in the global talent race -

Global Property Expo opens in Singapore next week as Asia’s influence in international real estate grows

Global Property Expo opens in Singapore next week as Asia’s influence in international real estate grows -

Engel & Völkers Snell Real Estate and Vanessa Fukunaga receive dual honours

Engel & Völkers Snell Real Estate and Vanessa Fukunaga receive dual honours -

Investor attention turns to Klīversala as exclusive Blue Marine development breaks ground

Investor attention turns to Klīversala as exclusive Blue Marine development breaks ground -

Greece’s TITAN Group climbs TIME’s global sustainability rankings

Greece’s TITAN Group climbs TIME’s global sustainability rankings -

Why Europe is turning its attention to Los Cabos, Mexico

Why Europe is turning its attention to Los Cabos, Mexico -

Cascaia, Vista Land’s Spanish-inspired estate, celebrates San Fernando’s lantern heritage

Cascaia, Vista Land’s Spanish-inspired estate, celebrates San Fernando’s lantern heritage -

Clarins heiress lists £6 million Notting Hill townhouse

Clarins heiress lists £6 million Notting Hill townhouse -

DoorBird is redefining industry standards with new products

DoorBird is redefining industry standards with new products -

Benefits of aluminium windows and doors in Built to Rent properties

Benefits of aluminium windows and doors in Built to Rent properties