Assessing the ESG investment landscape

ESG investment (environmental, social, governance) is increasingly becoming a mainstream practice – after all, such an approach is fundamentally concerned with the long-term financial health of investee companies – but still faces barriers to its complete acceptance. This article summarises the main conclusions from a recent webinar hosted by Responsible Investor, which featured expert speakers from the Global Reporting Initiative (GRI), State Street, Folketrygdfondet (Asset Manager for the Government Pension Fund Norway) and Refinitiv.

The speakers agreed with Elena Philipova, Global Head of ESG at Refinitiv, when she said that incorporating ESG data is “no longer an obscure investment decision, but the new norm”. At the same time, each speaker agreed with moderator, Carlos Tornero, that there are elephants in the room when it comes to ESG data.

Awareness and understanding

For one, the awareness and understanding of sustainability factors remain inconsistent throughout the investment chain, although institutions, issuers and proxy advisers are increasingly discussing such issues and adoption rates are growing.

Quality data

As Philipova pointed out on the webinar, investors are going from a market with a dearth of ESG information to one “where there is almost too much information coming at you”. One downside can be that much of the available ESG information is of an indeterminable quality, to which the panellists agreed.

Who should take responsibility for cleaning up this data? A recent Morgan Stanley report laid responsibility for a lack of uptake at the feet of corporates themselves: although a survey of 118 asset owners around the world finds that 80% of institutions are considering or already pursuing full ESG integration, about 24% say that a lack of “proof of financial performance” still posed a barrier to adopting a sustainable ethos completely, while 23% blamed a lack of quality data.

The move to ESG

ESG is increasingly being integrated by all relevant stakeholders. From a corporate perspective, thousands of corporates are now reporting ESG metrics while organisations like the Governance and Accountability Institute, SASB and the GRI have set out guidelines. The latter’s sustainability reporting framework has been adopted by 70% of the world’s 250 largest companies and stretches across 60 different countries and regions.

There are those leading the way for investors as well. For example, the UK government’s allowance for pension funds to dump fossil fuel stocks or France’s green bond that has a self-imposed ESG transparency requirement have laid the way for institutions to lead the charge.

The movement is being evidenced by a 2017 CFA Institute study finding that 69% of global portfolio managers and research analysts agreed that ESG disclosures should be subject to some level of independent verification.

Checks and standards

The webinar participants agreed that for ESG reporting and data to be universally accepted, there needs to be checks in place as well as active trust from the public and investors’ ultimate stakeholders. As Shivani Rajpal, the GRI’s Director of Services, put it: “It’s not the report at the end, but it’s actually what you do with the report that makes a difference.” (See Fig. 1)

Figure 1

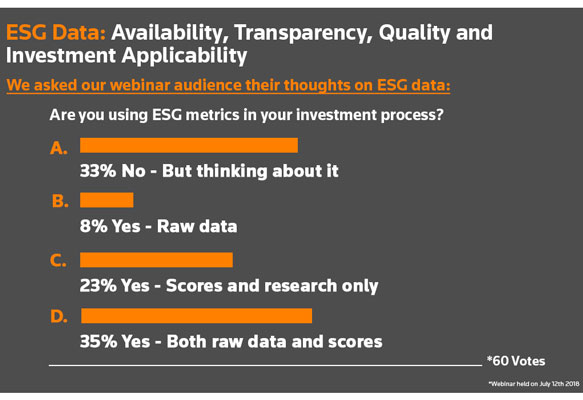

In today’s data landscape, however, there is more recourse than ever before for investors to find data that suits their decision-making process. Those who provide ESG information should be transparent not just about where they source their data, but also how it is sourced: understanding the methodology that providers use is crucial to understanding the figures that they provide. (See Fig. 2)

Figure 2

As State Street’s Senior Managing Director Rakhi Kumar said during the webinar, investors must be able to do their “due diligence” on any data they use. “It’s important for you all to really understand the philosophy that is driving the methodology scoring and all these differences to see if it aligns with what you believe in,” she added.

Using ESG data

One of the key ESG data “elephants” still to be properly dealt with is how it is used by institutions. Although it can be effective as just a measure of long-term profitability or of financial stability, using it properly requires a careful approach from investors to figure out what they are trying to achieve. (See Fig. 3)

Figure 3

As Annie Bersegel, Senior Analyst – Responsible Investments at Folketrygdfondet revealed, her institution considers good-quality ESG disclosures as an indication of how well companies build and maintain their strategic resources. She added: “We’re not looking for data for data’s sake, but rather to answer these kinds of questions to see how adaptable companies are for the future.”

Clarifying these aims can only lead to sustainability data becoming an increasingly powerful tool for investors of any size to include in their assessment of companies. The ESG elephants are making themselves known and, with effort from corporates and institutions alike, beginning to leave the room.

About Refinitiv

Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in over 190 countries. It provides leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community.

www.refinitiv.com