COVID-19 impact will see UK investors move to safer retail deposits

John E. Kaye

- Published

- News

According to GlobalData, a leading analytics company, retail investors in the UK will gravitate towards deposits and away from riskier high-yielding assets

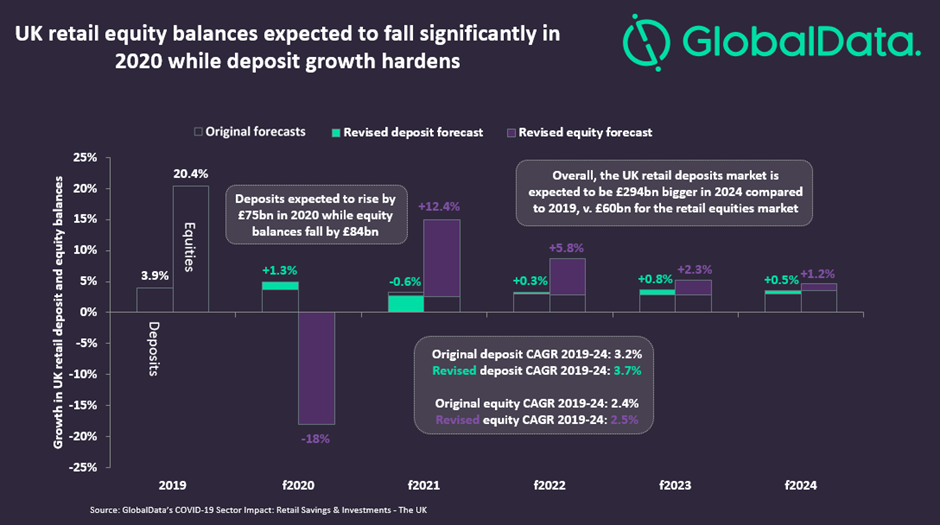

GlobalData’s report, ‘COVID-19 Sector Impact: Retail Savings & Investments – The UK’, discloses that equity balances are expected to fall by 18% in 2020 alone while retail deposit balances grow by 5%. While the decline for equities is made up for in the following years, the higher growth and large initial size of the retail deposits market shows the extent to which investors are set to turn towards safer assets.

Katherine Long, Banking and Payments Analyst at GlobalData, comments: “Higher deposit growth is also likely to benefit both incumbent and challenger banks. Already, retail savings platforms Raisin and Hargreaves Lansdown reported a surge in activity in March with savers looking for short-term, fixed-rate deposits.

“Their offers of deposit protection potentially above the usual £85,000 limit as well as interest rates of up to 2% make them a tempting case for consumers who are still nervous to invest. Additionally, with base rates lowered to just 0.1%, banks will be able to take advantage of consumer nervousness by simply offering a safe place for customers to store their money.”

In contrast, global stock markets have fallen drastically, The FTSE All-Share Index for example now down 24% after having recovered somewhat from the initial slide, but still volatile. The value of UK pensions, too, according to XPS Pensions, is down 8.4% in one quarter and expected to fall further, a reminder of how exposed pension funds are to the stock market.

Long concludes: “However, rather than prove a short-term phenomenon, the disruption has reversed the recent trend of retail investors looking for higher-yielding assets, instead seeking to bolster their safety net in deposits.”

For more information visit: www.globaldata.com

For more Daily news follow The European Magazine

RECENT ARTICLES

-

Deepfake celebrity ads drive new wave of investment scams

Deepfake celebrity ads drive new wave of investment scams -

WATCH: Red Bull pilot lands plane on moving freight train in aviation first

WATCH: Red Bull pilot lands plane on moving freight train in aviation first -

Europe eyes Australia-style social media crackdown for children

Europe eyes Australia-style social media crackdown for children -

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards -

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes -

Europe opens NanoIC pilot line to design the computer chips of the 2030s

Europe opens NanoIC pilot line to design the computer chips of the 2030s -

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’ -

Gen Z set to make up 34% of global workforce by 2034, new report says

Gen Z set to make up 34% of global workforce by 2034, new report says -

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now -

Lasers finally unlock mystery of Charles Darwin’s specimen jars

Lasers finally unlock mystery of Charles Darwin’s specimen jars -

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year -

Artemis II set to carry astronauts around the Moon for first time in 50 years

Artemis II set to carry astronauts around the Moon for first time in 50 years -

Meet the AI-powered robot that can sort, load and run your laundry on its own

Meet the AI-powered robot that can sort, load and run your laundry on its own -

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt -

Centrum Air to launch first European route with Tashkent–Frankfurt flights

Centrum Air to launch first European route with Tashkent–Frankfurt flights -

UK organisations still falling short on GDPR compliance, benchmark report finds

UK organisations still falling short on GDPR compliance, benchmark report finds -

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties -

Anniversary marks first civilian voyage to Antarctica 60 years ago

Anniversary marks first civilian voyage to Antarctica 60 years ago -

Etihad ranked world’s safest airline for 2026

Etihad ranked world’s safest airline for 2026 -

Read it here: Asset Management Matters — new supplement out now

Read it here: Asset Management Matters — new supplement out now -

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now -

The new Residence & Citizenship Planning supplement: out now

The new Residence & Citizenship Planning supplement: out now -

Prague named Europe’s top student city in new comparative study

Prague named Europe’s top student city in new comparative study -

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness