Is this the dawn of a ‘lithium OPEC’?

Elias Ferrer looks at recent developments in Latin America’s lithium mining sector, and examines which countries are best set to capitalise on the boom

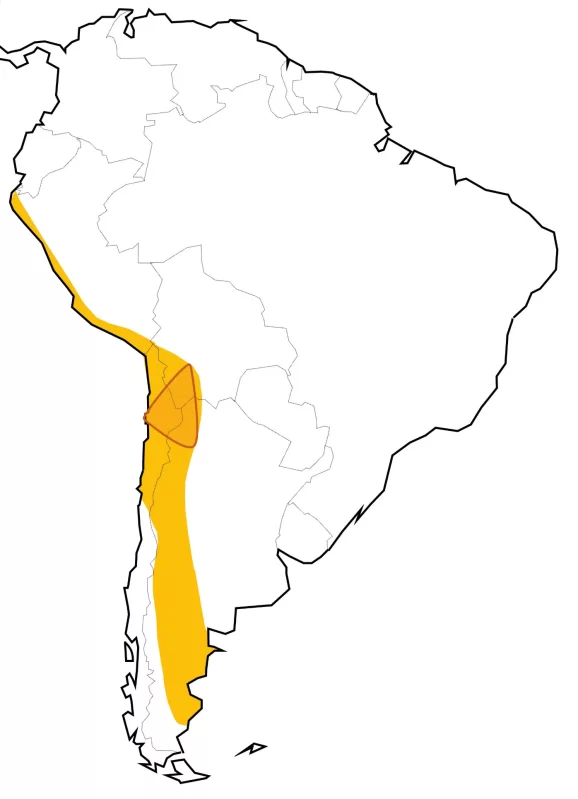

A group of Latin American countries looks set to cooperate in lithium mining, and in the process, take control of the majority of the world’s reserves. Chile, Bolivia, and Argentina hold around 50 million tonnes (53% of global reserves) of the metal within the so-called “Lithium Triangle”. Such an alliance could monopolise the extraction of lithium and set global prices of the raw commodity, just as OPEC does for oil.

Argentina, Bolivia, Chile, and Brazil could create a so-called “OPEC for lithium”, with an Argentinian delegation raising the idea at a mining convention in Canada earlier this year. Argentina, Bolivia and Chile have been in talks since July 2022, while Brazil joined after President Luis Ignácio “Lula” da Silva’s inauguration in January.

The importance of lithium to the global economy cannot be overstated. It is an essential component for electric vehicles (EV) batteries, and is vital to a new era of cleaner, greener technologies. Although prices have fallen by 70% since their peak in November of 2022, the “lithium boom” is far from over. This year, mining deals for the metal have risen to decade highs of $65bn, as organisations scramble for a share of highly lucrative sector.

Ambitious Argentina faces largest hurdles

Buenos Aires is taking a prominent role in pushing for this lithium alliance. It has the world’s second-largest proven reserves, but comes fifth in production. Its manufacturing sector is also smaller than Brazil’s.

JP Morgan analysts are nonetheless projecting that it will become the third producer by 2030.

Argentina’s President Alberto Fernández is also trying to take the lead in regional politics, hosting the CELAC summit of heads of state and foreign ministers earlier this year, bringing together Latin America and the Caribbean. However, Argentina may still face the most challenges to get production going. The economy is currently hampered by export restrictions, large debt, high inflation and a crumbling currency. Politics are adding another hurdle to the South American country’s export potential. For example, it has a comparative advantage on agricultural products such as beef, soya, and sunflower oil, and these products are in high demand in China. However, they face hefty export taxes or even bans on certain products, such as popular beef cuts, limiting its balance of trade.

The Lithium Triangle of Chile, Bolivia, and Argentina

Outside of the Lithium Triangle, smaller, yet significant reserves have also been found in Mexico, with 1.7 million tonnes, and in Brazil, with 500,000 tonnes. Although the two countries have less of the metal to mine, they have more developed industries. Brazil also has a relatively strong manufacturing sector, especially compared to its neighbours – Sigma Lithium is one of the few companies in Latin America capable of processing the mineral sustainably.

Green mobility made in Mexico

Mexican President Andrés Manuel López Obrador (aka AMLO) is nationalising lithium reserves. However, this does not mean that the resource will be off-limits to private investment. Tesla and the Mexican government confirmed plans for a new EV battery factory in Nuevo Leon, near the US border. AMLO is also envisioning central Mexico as a manufacturing hub for batteries, amongst the country’s largest mines and production facilities. In February, BMW announced plans to invest $865m to step up electric vehicle production in the central state of San Luis de Potosí.

Mexico has the strongest manufacturing sector of all the countries involved, and is well-placed to export to the hungry US market, both geographically and in terms of existing trade deals. The likely growth in manufacturing is part of the reason why JP Morgan recently argued for giving Mexico a positive outlook – as opposed to the other regional giant, Brazil, which according to the report has gloomier prospects. Both economies have nonetheless exceeded growth expectations for the first quarter of 2023.

Chile’s plans to nationalise lithium

Just this April, Chilean President Gabriel Boric declared intentions to nationalise the country’s lithium reserves. He has also made environmental commitments, such as leaving 30% of all salt flats untouched – the area where the metal is found.

Chile, among others, is likely to end up with a public-private mining system where the state is able to collect high rents. The president has also announced that an association of private firms will lead the industry alongside the state.

Some development economists are concerned that there are no declared commitments to expand across the supply chain or obtain new technologies. Instead, plans for nationalisation across the region have generally meant greater rents for the state. While holding smaller lithium deposits, Brazil and Mexico are going against this trend with their EV manufacturing ambitions. They could eventually become leaders in the sector as they already have strong automobile industries, larger markets and stability.

The new oil?

As mentioned, the importance of lithium and other metals essential to EV batteries cannot be overstated for their role in the global energy transition. In January, commander of the US Southern Command, General Laura J. Richardson highlighted the region’s wealth of these resources at the Atlantic Council. Both the US and China are showing increasing interest in the mining of lithium and its manufacturing process.

Just as OPEC brought wealth and power to Arab and Middle Eastern states, it has also brought conflict and instability. Prolonged wars in Iraq and Libya are just some recent examples. Likewise, while a lithium cartel could reinforce Latin America’s position, it will exist in a framework of great power competition.

About the Author

Elias Ferrer is an emerging market analyst at Swaps Monitor, freelance writer and SOAS graduate.

Main image: A lithium mine at the Salinas Grandes salt desert, Jujuy Province, Argentina