Balancing the books on Britain’s tax injustice

John E. Kaye

In the UK, if those who earn income from investments were taxed more fairly, then the burden on workers could be reduced, argues author and economist Sebastian Chambers

In April, British Chancellor Rishi Sunak pressed ahead with a 2.5% increase in National Insurance (NI) contributions. The shortfall in taxes was yet again to be made up by workers, rather than by the wealthy – those of us who really understand how unfair this is kept quiet. We have kept quiet for a long time and one day we are going to be found out. The disparity in the way the tax burden impacts work versus wealth in Britain is shameful. One of the reasons why tax is not better understood is that it is both complicated and boring – not ingredients that typically get a journalist reaching for the calculator app on their mobiles. So, let try and unpick the different ways the UK tax and benefits system treats those who earn from work, as opposed to those that earn from their investments.

A single parent returning to work pays a marginal rate of tax of 33% (income tax, 20%, NI 13.25%). The marginal rate is the rate on the last pound they earn. We then need to add the 15.55% their employer pays in NI and Apprenticeship Levy (15.05% and 0.5% respectively). Then the tricky bit, how much benefits do they lose because of going back to work? A typical answer is about 12%. Then you add this lot up, at which point I needed to open a spreadsheet; the last pound their employer paid benefited the taxman by 52p and the single parent by 48p. Interestingly, a parent who earns too much to be entitled to Child Benefits also loses about 12p in the pound. The taxman does not seem to like working parents

Now for the graduate in their first job. It is the same 33.25% plus 15.55% and then you can add the 9% student loan repayment. Not that it is an actual repayment as the student loan attracts 12% interest so that 9% deduction of pay is hardly covering the interest. The young person gets to keep 50p in the pound their employer pays out.

How about the company director on £100,000? The employer cost of 15.55% is the same. Employees’ NI is reduced to 3.25%, but income tax is upped to 40%. And then the sting in the tail – an additional 20% income tax is paid – as the Personal Allowance is taken away. A bit more spreadsheeting and the company director keeps 32p in the pound. That is a 68% marginal rate of tax – it is not just the current rate of inflation that reminds us of the 1970s. You might not have much sympathy for anyone on £100k, but these people are working and employing colleagues. All wealth is created by work. Heavy taxation discourages work and makes society poorer.

Keeping quiet about it

Now let us look at some of the taxes on unearned income. This is less complicated – no need for a calculator, let alone a spreadsheet. Here are a few of my favourites:

- Income Tax, NI and Capital Gains Tax in the ISA portfolio – tax 0p. This uncapped portfolio can be worth millions for a family and generates as much money as a normal family earns in a year entirely tax-free.

- Income Tax, NI and Capital Gains Tax in the pension portfolio – tax 0p. Like an ISA but capped at just over a £million; but not so bad as you pay no Income Tax or NI on the original pension contribution.

- Capital Gains Tax on the first £12,300 of profits from the sale of shares – tax 0p.

- Tax on farmland – not a lot when you consider the subsidies received. Agricultural subsidies are the only bit of our benefits system that is neither means-tested nor capped.

- Income Tax, NI and Capital Gains Tax in the offshore portfolio – tax 0p.

Is it surprising therefore that the people who understand this stuff keep quiet about it?

Mechanisms for change

How hard would it be to rebalance taxation to reduce the burden on workers? The first thing would be for HMRC to review all marginal tax rates and benefit reductions to be set at levels where the worker never receives less than 50p in the pound. For the lower-paid this should be 40p. This could be paid for by dramatically changing the rules for the rich. ISAs should be scrapped. So should tax relief on pension contributions – a relief that is only needed because taxes on employment are so high anyway. The Capital Gains Tax allowance should also go. The tax and subsidy regime for farmers needs a complete reset. The Chancellor is well placed to understand how we can increase the tax take from those with offshore interests.

More fundamentally, we need to simplify the tax code that now runs to over 17,000 pages. Much of that code creates rules that companies and wealthy individuals can exploit and that ordinary people have no access to.

To take one example, companies can deduct interest payments before they pay tax; working people pay their tax first and then pay any interest they owe. That is why a professional landlord can outbid someone trying to buy their first home. These distinctions between how the wealthy are taxed versus most people are extraordinarily unfair and is creating a polarised society.

Ultimately, if those who earn income from investments were taxed more fairly, then we could reduce the tax burden on those who work.

ABOUT THE AUTHOR

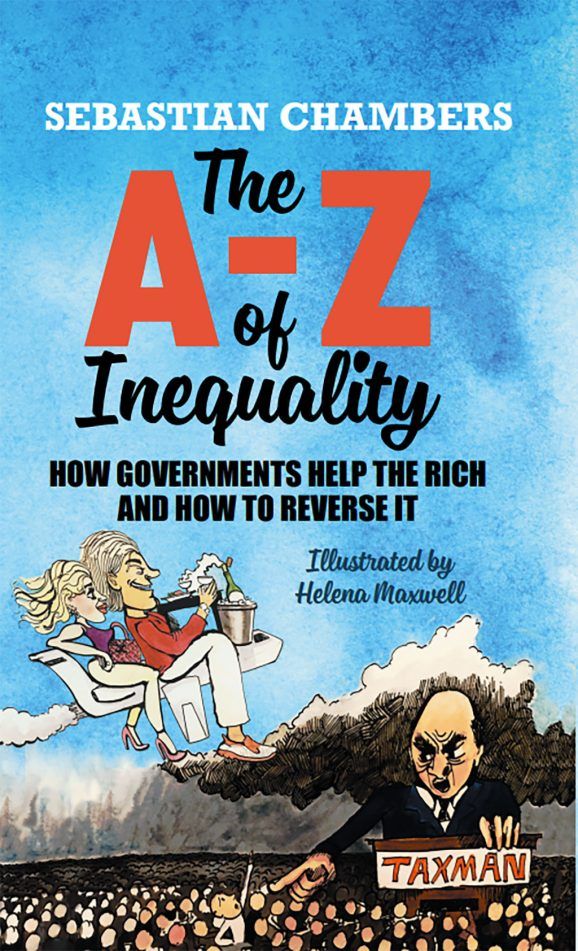

Sebastian Chambers is a non-executive director of CIL Management Consultants, Neptune and STL Tech and is an active angel investor. A Chartered Accountant, he has a degree in economics and social sciences from Manchester University. He is the author of ‘The A-Z of Inequality’, published by White Fox, priced at £10 and available at Amazon.

Further information

RECENT ARTICLES

-

Managing cross-border risks in B2B e-commerce

Managing cross-border risks in B2B e-commerce -

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership

Research highlights rise of 'solopreneurs' as technology reshapes small business ownership -

Human resources at the centre of organisational transformation

Human resources at the centre of organisational transformation -

UK government sets up Women in Tech taskforce amid gender imbalance concerns

UK government sets up Women in Tech taskforce amid gender imbalance concerns -

Liechtenstein lands AAA rating again as PM hails “exceptional stability”

Liechtenstein lands AAA rating again as PM hails “exceptional stability” -

The Parisian business school quietly reinventing the MBA

The Parisian business school quietly reinventing the MBA -

UK entrepreneur who founded £1bn firm acquires UAE amateur golf leader to launch world amateur Super League

UK entrepreneur who founded £1bn firm acquires UAE amateur golf leader to launch world amateur Super League -

Why your home is the best place to teach children leadership

Why your home is the best place to teach children leadership -

Inside the Spring 2025 Edition of The European

Inside the Spring 2025 Edition of The European -

The Paris MBA designed for real-world leadership

The Paris MBA designed for real-world leadership -

Soft2Bet reflects on eight years of leadership and philanthropy in new film featuring CEO Uri Poliavich

Soft2Bet reflects on eight years of leadership and philanthropy in new film featuring CEO Uri Poliavich -

Global Banking School celebrates ‘milestone’ anniversary

Global Banking School celebrates ‘milestone’ anniversary -

Saudi Arabia hosts the fourth Riyadh International Humanitarian Forum

Saudi Arabia hosts the fourth Riyadh International Humanitarian Forum -

New York Congresswoman pushes for Trump’s birthday to be enshrined as federal holiday

New York Congresswoman pushes for Trump’s birthday to be enshrined as federal holiday -

Red light, green bite: Netflix restaurant opens in Vegas

Red light, green bite: Netflix restaurant opens in Vegas -

Read our Cybersecurity Focus supplement, featuring insights from Information Security Forum

Read our Cybersecurity Focus supplement, featuring insights from Information Security Forum -

Davos World Economic Forum 2025: Collaboration for the Intelligent Age

Davos World Economic Forum 2025: Collaboration for the Intelligent Age -

The European releases its Winter 2024/25 edition

The European releases its Winter 2024/25 edition -

Read our FDI Focus supplement, featuring insights from Michael Lohan of IDA Ireland

Read our FDI Focus supplement, featuring insights from Michael Lohan of IDA Ireland -

PizzaExpress to Expand Dough Base Stateside

PizzaExpress to Expand Dough Base Stateside -

The two core skills middle managers need to navigate stormy weather

The two core skills middle managers need to navigate stormy weather -

The Role of Financial Regulations in the Online Casino Industry

The Role of Financial Regulations in the Online Casino Industry -

How to become a game-changer

How to become a game-changer -

Taking the risk out of BOP ventures

Taking the risk out of BOP ventures -

Releaf leading the way with marketing

Releaf leading the way with marketing