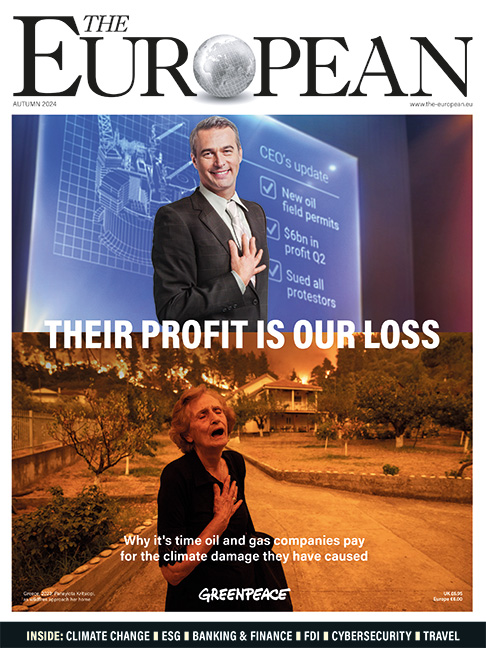

As Qatar prepares to host the 2022 FIFA World Cup, global businesses will be eyeing new commercial opportunities. Here, Sharq Law Firm unpacks the legal side

Historically, for companies wishing to incorporate under the Ministry of Commerce & Industry (MoCI) the Qatari legislator has always mandated for non-Qataris to require a local Qatari partner owning 51% of the company share capital prior to issuing a commercial register.

Previously, in accordance with Law No. 13 of 2000 Promulgating the Foreign Investment Law, foreign investors could not operate under the mainland in the State of Qatar without a local Qatari partner, this barrier deterred major international corporations and brands from entering the Qatari market out of fear of loss of control, brand image etc.

This brief hight-level article will analyse the relevant legislation and provide further insight into the legal and commercial considerations non-Qataris must deliberate over in determining the incorporation of a wholly owned non-Qatari company. In light of Qatar’s 2030 vision and the upcoming FIFA World Cup 2022, which is set to place Qatar on the world map, the Qatari legislator has consciously endeavoured to negate any barriers to entry which foreign investors previously had – for the purposes of this article, mainly the requirement to require a local Qatari partner.

This historical change came with the backdrop of equally important legislations concerning the labour and social fabric of the Qatari society which was all geared at creating a global business hub attracting and maintaining foreign investment.

The Foreign Investment Law

Whilst the Foreign Investment Law is expansive and unprecedented in its scope, it prohibits non-Qataris from investing in the following sectors:

- Banks and insurance companies, except for what is excluded by a decision of the Council of Ministers.

- Commercial agencies; and,

- Any other areas for which a decision is issued by the Council of Ministers.

GCC Nationals

Gulf Cooperation Council (GCC) nationals may incorporate 100% owned companies without needing to utilise the Foreign Investment Law. In such cases, the standard route will be followed accompanied by a letter to the Commercial Registration and Licenses Department at the MoCI requesting for an exemption.

Non-Qatari and Non-GCC nationals

For a non-Qatari investor to incorporate a limited liability company under the Foreign Investment Law, the following steps are required:

- Reserving the company name at the MoCI.

- Submitting the supporting documents to the Business Development & Investment Promotion Department at the MoCI, to include: business plan; market analysis; financial analysis documents; and operational analysis.

- Submitting the good conduct certificate and the CV

- of the partners.

- Completing the Non-Qatari Investment License Application.

- Drafting and submitting the company Articles of Association.

- Obtaining approval of the Articles of Association from the Companies Control Department.

- Signing the Articles of Association at the Ministry of Justice.

- Submitting the application requesting the Issuance of a new Commercial Register.

Incorporation timeframe

The Foreign Investment Law provides the MoCI with a window of 15 days to respond to the application post-submission. A non-response is deemed as an implied rejection. This timeframe only commences upon the submission of all the required documents and not from the initial contact with the MoCI (for example, if the documents are submitted incomplete, the 15-day window will not have commenced as the response period begins upon the submission of all the required documents).

Lapse of timeframe

The Foreign Investment Law prescribes a “grievance” procedure should the application be expressly or impliedly rejected. A rejected applicant may appeal the decision to the Minister of the MoCI within 15 days from the date of their knowledge of the rejection decision, or from the date on which the application is deemed rejected. The Minister shall decide on the grievance within 30 days from the date of its submission, and the expiration of this period without deciding on the grievance is deemed an implied rejection.

Transfer of investments outside of Qatar

A non-Qatari investor is free to make all transfers of investments to and from abroad without delay, and

these transfers include:

- Investment returns

- Proceeds from selling or liquidating all or part of

- the investment.

- The proceeds of the sums resulting from the

- settlement of investment disputes.

Transfers shall be made in any convertible currency, at the exchange rate in effect on the date of the transfer.

Foreign Investment Law and the QFC

The Foreign Investment Law does not seek to compete with the QFC; the QFC has its own advantages including:

- The separate legal and regulatory business infrastructure offered by the QFC.

- The use of “English” as the dominant language as opposed to “Arabic”, and,

- The nature of the activities: some of which are restricted under mainland MoCI (including banks and insurance providers).

On the other hand, the MoCI offers certain advantages which the QFC does not, including:

The ability to invest in all sectors including Retail, F&B whereas the QFC orientates around financial/technological related investments, this may mean a company having two companies using the QFC for management/IT related matters and the MoCI for activities which the QFC prohibits.

How can Sharq Law Firm help?

As Sharq has extensive experience in incorporating companies under the MoCI and QFC and has assisted major regional and international brands in setting up operations in Qatar, it can assist on the following (in addition to the general company incorporation):

- Assisting on ensuring all commercial documents including market analysis, business plans,

- Operational analysis all address the points of importance to the MoCI to prevent any delays in obtaining the approvals; and,

- Liaising closely with the MoCI and following up on all additional matters until the Commercial Register is issued.

Conclusion

Undoubtedly, the Foreign Investment Law has further provided investors with an alternative avenue to exploring the local Qatari market. This option although relatively new has proven to have been positively acknowledged by investors with several known international brands incorporating under this legislation. However, it remains to be seen the long-term consequences of this legislation and its procedural application thereof at the MoCI.

This article is intended to shed light on the Foreign Investment Law at a high level and should not be taken as legal advice.

For further information:

www.sharqlawfirm.com

info@sharlawfirm.com