Practical advice for businesses on coping with another variant

John E. Kaye

- Published

- Executive Education, Home, News

From cash-flow to supply-chains, what businesses can do to protect their future

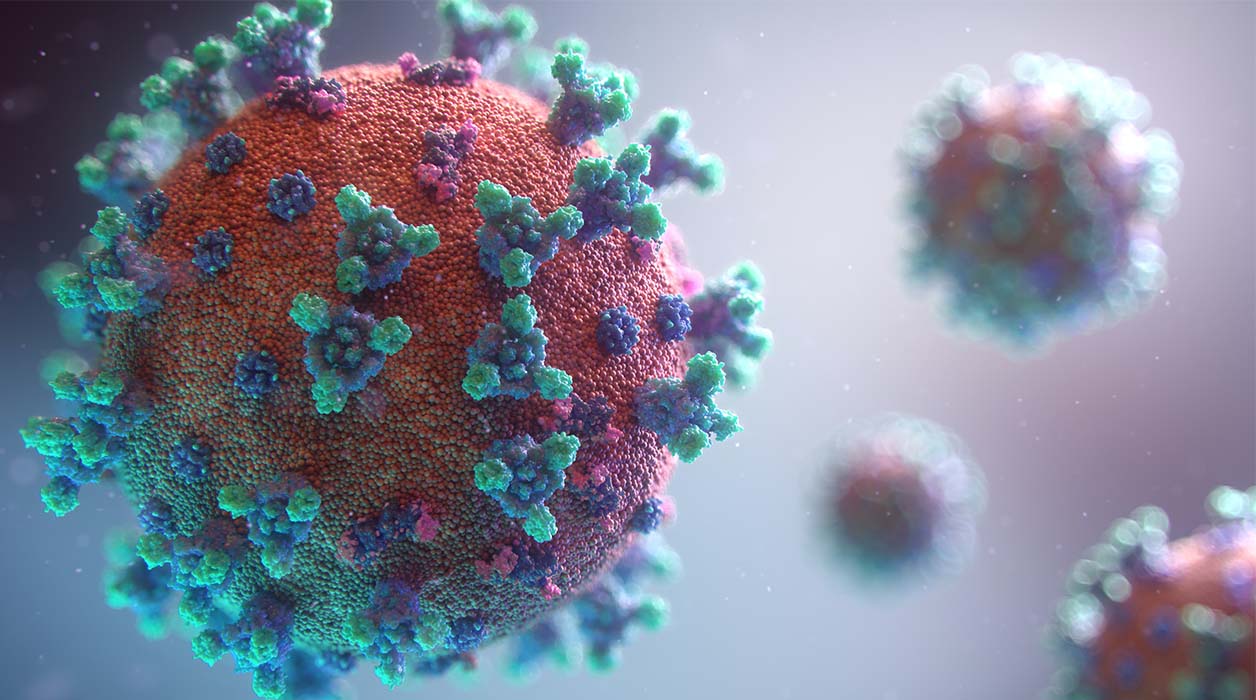

Over the past few weeks, a new twist in the story of the COVID pandemic has emerged – the Omicron variant. It is the latest issue facing an ever-changing global landscape, causing more uneasiness for global stocks and markets, forcing businesses to act rapidly to successfully adapt and adopt new strategies and methods to combat this new risk and prepare themselves for the future.

The Omicron effect

The world is now on high alert, with the World Health Organization stating that the Omicron variant poses a ‘very high’ global risk, causing stock markets to fall the world over. It was announced on the 27th of November that the first Omicron case had been discovered in the United Kingdom – meaning that UK businesses will likely have to deal with this potential new threat in the near future, with the cases of the original Omicron variant rising in the UK by 101 on Tuesday, taking the total number of cases detected in the UK to 437. The spread of the Omicron variant already appears to be doubling every two to three days, with Omicron likely to be the dominant strain of COVID in the UK before Christmas.

In many ways Omicron is both nothing new and the next frontier of SME’s having to battle COVID. Whether or not Omicron will cause major impact on the economy remains to be seen, however Western Governments are unlikely to provide support additional large scale to SME’s as they would prefer to keep the economy open and utilize various other tactics such as limited capacities, vaccine passports and etc to manage the virus. Consequently, SMEs are going to need to take mitigating the impact of COVID into their own hands.

RWT Growth- a sustainability driven consultant, is dedicated to supporting businesses worldwide and developing corporate strategies to combat the Omicron variant and prepare businesses for the future. With this in mind, founding Partner of corporate advisory firm RWT Growth has analysed what uncertainty could mean for the UK M&A market, especially for SMEs:

Reece Tomlinson, founding Partner of RWT Growth discusses the need of UK businesses to act fast in combatting the Omicron variant:

“This is a small glimpse into what is developing into the future for UK businesses, with several COVID variants already emerging and more predicted to develop in the future, businesses must be ready to adapt at the drop of a hat and have an astute crisis plan in place. Their leaders must also successfully prepare their companies to navigate the ever-changing business environment caused by the COVID pandemic, the longer the pandemic continues, the more important creating a safe space and culture for workers becomes.

“There are four critical areas in which UK SMEs must protect themselves against the Omicron variant, firstly you must do the upmost to protect your team, follow protocols and implement policies that ensure COVID is least likely to spread in your workplace. SMEs must implement these policies to ensure that it protects their ability to conduct business by ensuring their workplace is as COVID-free as possible.

“Secondly, SMEs must ensure they instil COVID confidence, with the higher degree of confidence that customers have in your business relating to the more they come and do business with you.

“SMEs must ensure that they also get capitalised, meaning that the company has enough liquidity on the balance sheet to weather disruptions caused to your business and short-term lockdown measures implemented by governments. It is vital to ensure credit facilities are bumped as high as possible to give the SME more leeway if and when it is needed.

“Finally, SMEs must be well stocked, the Omicron variant will likely further challenge the already constrained global supply chains, subsequently causing many retailers to state that as much as 30% of their inventories are in transit, meaning that SMEs will have less products available to sell. It is pivotal that SMEs are adequately stocked, especially considering the additional threat from the Omicron variant, they must be well stock and carry enough inventory needed to continue to thrive during these challenging times.”

RECENT ARTICLES

-

WATCH: Red Bull pilot lands plane on moving freight train in aviation first

WATCH: Red Bull pilot lands plane on moving freight train in aviation first -

Europe eyes Australia-style social media crackdown for children

Europe eyes Australia-style social media crackdown for children -

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards

These European hotels have just been named Five-Star in Forbes Travel Guide’s 2026 awards -

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes

McDonald’s Valentine’s ‘McNugget Caviar’ giveaway sells out within minutes -

Europe opens NanoIC pilot line to design the computer chips of the 2030s

Europe opens NanoIC pilot line to design the computer chips of the 2030s -

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’

Zanzibar’s tourism boom ‘exposes new investment opportunities beyond hotels’ -

Gen Z set to make up 34% of global workforce by 2034, new report says

Gen Z set to make up 34% of global workforce by 2034, new report says -

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now

The ideas and discoveries reshaping our future: Science Matters Volume 3, out now -

Lasers finally unlock mystery of Charles Darwin’s specimen jars

Lasers finally unlock mystery of Charles Darwin’s specimen jars -

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year

European Commission issues new cancer prevention guidance as EU records 2.7m cases in a year -

Artemis II set to carry astronauts around the Moon for first time in 50 years

Artemis II set to carry astronauts around the Moon for first time in 50 years -

Meet the AI-powered robot that can sort, load and run your laundry on its own

Meet the AI-powered robot that can sort, load and run your laundry on its own -

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt

Wingsuit skydivers blast through world’s tallest hotel at 124mph in Dubai stunt -

Centrum Air to launch first European route with Tashkent–Frankfurt flights

Centrum Air to launch first European route with Tashkent–Frankfurt flights -

UK organisations still falling short on GDPR compliance, benchmark report finds

UK organisations still falling short on GDPR compliance, benchmark report finds -

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties

Stanley Johnson appears on Ugandan national television during visit highlighting wildlife and conservation ties -

Anniversary marks first civilian voyage to Antarctica 60 years ago

Anniversary marks first civilian voyage to Antarctica 60 years ago -

Etihad ranked world’s safest airline for 2026

Etihad ranked world’s safest airline for 2026 -

Read it here: Asset Management Matters — new supplement out now

Read it here: Asset Management Matters — new supplement out now -

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now

Breakthroughs that change how we understand health, biology and risk: the new Science Matters supplement is out now -

The new Residence & Citizenship Planning supplement: out now

The new Residence & Citizenship Planning supplement: out now -

Prague named Europe’s top student city in new comparative study

Prague named Europe’s top student city in new comparative study -

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness

BGG expands production footprint and backs microalgae as social media drives unprecedented boom in natural wellness -

The European Winter 2026 edition - out now

The European Winter 2026 edition - out now