With a solid reputation as an international finance centre, the Isle of Man has long been recognised as a safe and secure commercial centre. But recent diversification and renewed focus on attracting new business means there has never been a better time to consider the Isle of Man as your base to live, work and do business.

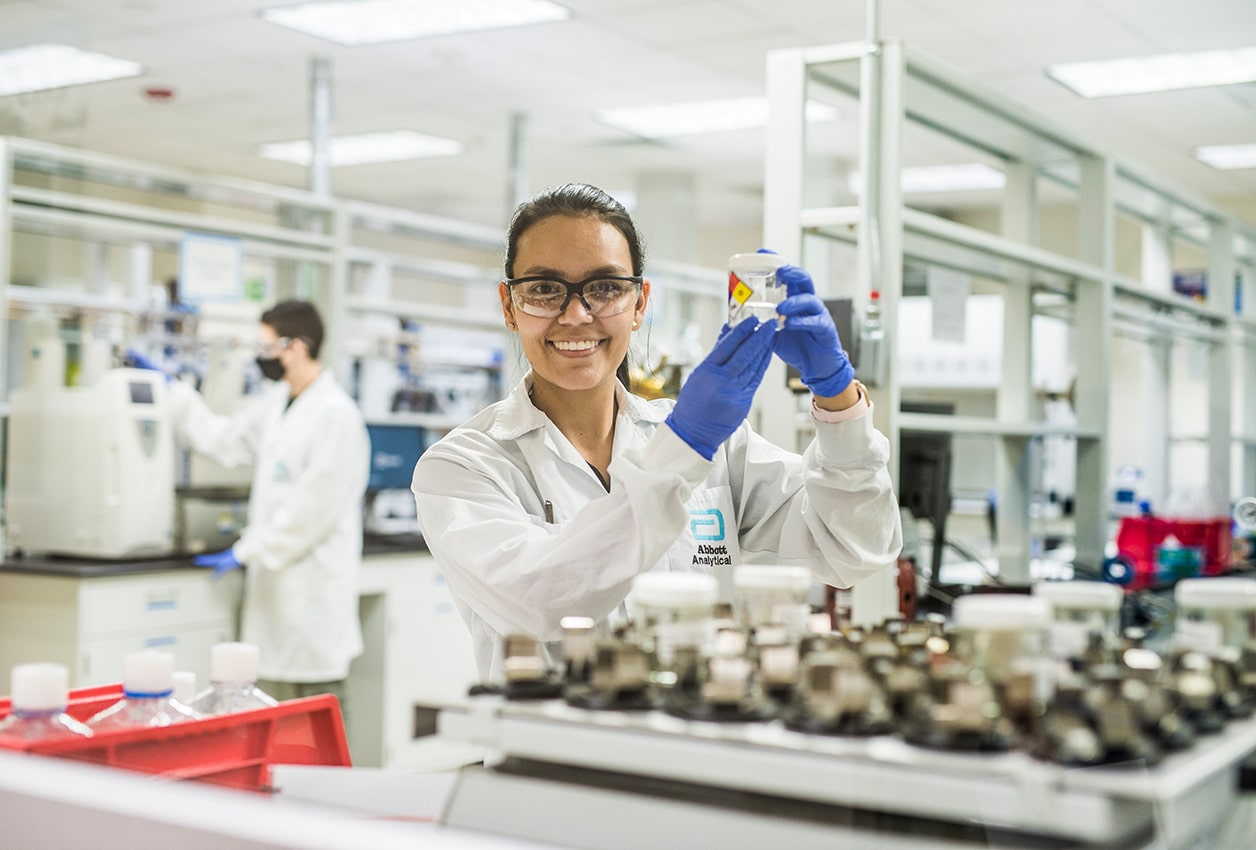

Regulation in the Isle of Man is among the best in the world, having made an early commitment to meet international standards against money laundering, terrorist financing and corruption. Expanding on foundations of transparency, safety and security is an exceptional infrastructure and a natural appetite for innovation – the island’s economy is reassuringly diverse and spans a number of sectors, including everything from manufacturing and engineering to biomedical sciences and food and drink retail. Previously, the island’s extensive financial services sector had been the largest sector but this has recently been surpassed by digital sectors – including eGaming, fintech and digital media – a trend which looks set to continue with recent commitment to a national telecommunications strategy and the introduction of a new blockchain office, which offers a dedicated support network for businesses utilising blockchain technology.

The Isle of Man attributes much of this success to its welcoming business ecosystem; public and private sectors work regularly in partnership to ensure the government remains responsive and proactive when anticipating the needs of business. This collaborative approach means that the local ecosystem is well connected, agile and inspired with a can-do attitude. This is combined with a wealth of financial, technical and practical support available for anyone looking to establish a new, or expand an existing business proposition within the island.

There are a number of benefits to doing business in the Isle of Man: businesses benefit from 0% corporate income tax and there are also no capital gains, inheritance tax or stamp duty payable – on either commercial or residential properties. Personal tax rates are attractively low, with a lower rate of 10% and top rate of 20% payable after a tax-free allowance of £14,000 per person each year.

It is certainly a convincing business case, but perhaps more compelling is the quality of life on offer for those who choose to live, work and invest in the island. In contrast to Douglas, the island’s capital and commercial hub, is the miles of unspoiled coastline and breathtaking natural landscapes. In 2017, the island was the first place to be named a UNESCO Biosphere – a status that acknowledges a commitment to the natural landscape and the continued balance of people, business and nature. The education and healthcare systems are excellent, and it was recently ranked the best place to live in the British Isles, and 12th best in the world, for expats in the annual HSBC Expat survey 2019.

Further information