BNI: equal to every challenge

Banco Nacional de Investimento (BNI) was founded in 2010 as a partnership between the Mozambican government (through the National Treasury Department) and the Portuguese government (through Caixa Geral de Depósitos-CGD), in order to facilitate a closer cooperation and promote various projects between the two countries.

However, in December 2012, the Mozambican state, through its equity agency Instituto de Gestão das Participações do Estado (IGEPE), acquired the CGD participation and became a 100% state-owned company, with focus on development and investment.

BNI is a development and investment bank that aims to promote social and economic development, and improve living standards for the people of Mozambique. The bank hopes to achieve this through financing and overseeing both public and private projects, along with financing enterprises relevant to the growth of the country.

BNI is chaired by Dr Tomas Matola, who has been CEO and President of the Board of Directors since January 2015. Two executive board members, both appointed by the Instituto de Gestāo de Participações do Estado (IGEPE) and approved by the Ministry of Finance, support him in his work.

Dr Matola and his team were appointed to manage BNI in the aftermath of the 2015 financial crisis, in contrast the Mozambique economy performed well in the following period, growing at an average of 7.5% a year.

Mozambique has been one of the fast growing economies in the world over the last decade. It achieved a stable macroeconomic environment by the end of 2014, characterised by an average inflation rate of 2.56%, a stable exchange rate and an expansionary monetary policy where credit to the economy grew 28% compared to 2013 and benchmark interest rates were continuously cut to stimulate the economic activity.

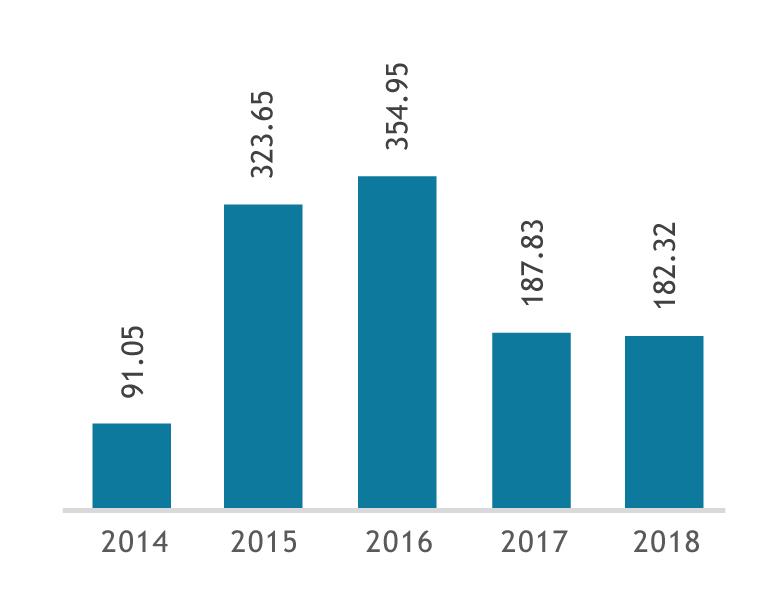

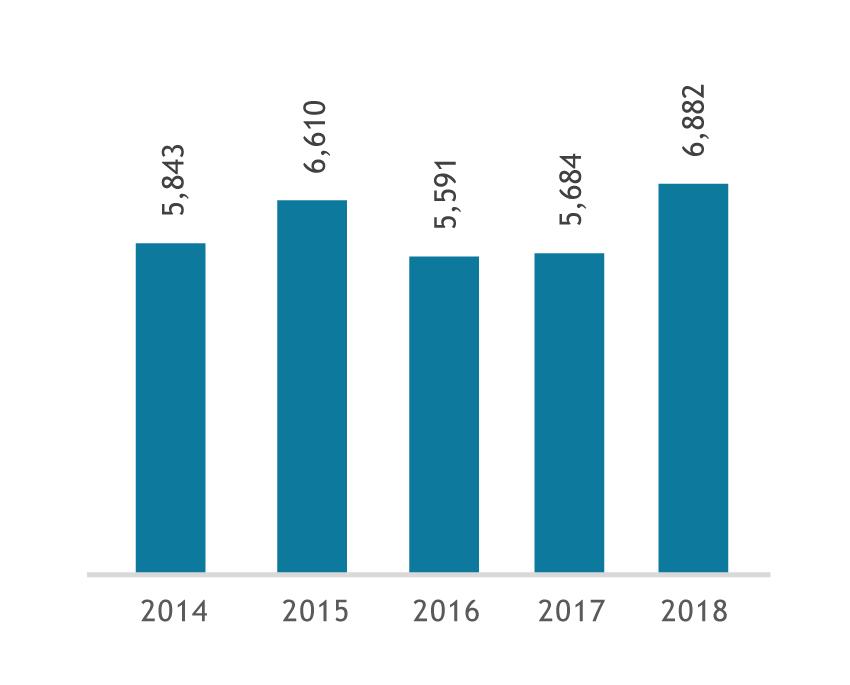

BNI closed the 2014 financial year with a net profit of MZN91m ($1.5m), a net operating income of MZN340m, a net asset of MZN5.843m, and shareholders’ fund of MZN2.384m. Under the management of Minister for Finance Adriano Maleiane, performance indicators were sound with a focus on the capital adequacy ratio of 66.7%, ROAE of 3.88% and ROAA of 2.22%.

A period of adversity

By the start of 2015, the global economic crisis that was affecting most of the world’s largest economies was showing signs of spreading to Mozambique – which had been previously growing at an above average rate for the region. The decline in consumption in China, the political instability of certain oil-producing countries and the excess of supply, precipitated a fall in commodity prices. This affected the volume and value of the Mozambique’s primary exports and contributed to a lack of foreign currency in the economy.

In addition to this, internal factors such as public debt, political and military uncertainty and natural disasters worsened Mozambique’s economic situation, creating a depreciation of the metical against key transaction currencies. An increase in inflation above one digit generated a liquidity crisis in the Mozambican financial system.

From 2016, the Mozambican economy has continued to face significant challenges, which have prevented robust growth. GDP has been growing on average 3.4% over the last three years. This poor economic performance can be explained by a number of factors, namely: the continued suspension of direct support to the state budget; the reduction of foreign investment levels due to the degradation of the country’s rating in international financial markets; unsustainable adjustments to fiscal and budgetary policies imposed against the level of internal and external debt; a decline in credit to the economy, which limited the performance of the private sector and contributed to the decrease of production and the level of aggregate supply.

These factors, combined with significant increases in domestic lending rates, weakened the private sector, affecting its ability to honour financial commitments held with various financial institutions, including BNI. All of which forced BNI to restructure and compromised the quality of the bank’s credit portfolio. The Investment Banking segment was also affected, as some advisory mandates were not implemented while many companies adjusted to the new challenging conditions.

Reviving fortunes

Achieving a robust and sustainable performance in such an adverse commercial landscape meant the Board of Directors reformulating its business strategy. This new strategy focused on the following areas:

- Prioritising the diversification of revenue sources.

- Additional monitoring and improvement of credit risk management.

- Increased recovery of bad debt, therefore minimising credit losses, while also adopting a more balanced, risk-averse approach to the investment portfolios.

- Increased focus on establishing strategic partnerships with local, regional and international development institutions for infrastructure projects in the country that required structuring and fundraising for the development of infrastructure projects in the country using long term and concessional funding.

Implementing these policies proved successful, allowing BNI to achieve positive results in the period 2015 to 2018 and maintain a robust economic and financial performance. The adverse macroeconomic environment in the country drew creativity, courage and commitment from the team at BNI. The bank achieved a range of strategic goals. The following highlight the bank’s high level of performance during this period:

- Generation of average profits of MZN237m a year – totalling MZN947m ($15.4m) over the four years. Representing a 160% growth compared to 2014 net profit.

- Increase of shareholders’ funds by 45%, from MZN2.384m in 2014 to MZN3.461m in 2018.

- Growth of total assets by 200%, equivalent to MZN4.530m, from MZN2.350m in 2014 to MZN6.880m by end of 2018.

- Payment of dividends to the shareholder amounting to MZN155m, representing a yearly average of MZN39m, compared to MZN10m in 2014, an almost 290% increase.

- Sound capital adequacy ratio of 32% in 2018, above the minimum of 9% required by the regulator.

- Achievement of a liquidity ratio measuring the ability of the bank to honour its short-term commitments of 185% in 2018, well above the minimum of 25% required by Mozambique’s central bank.

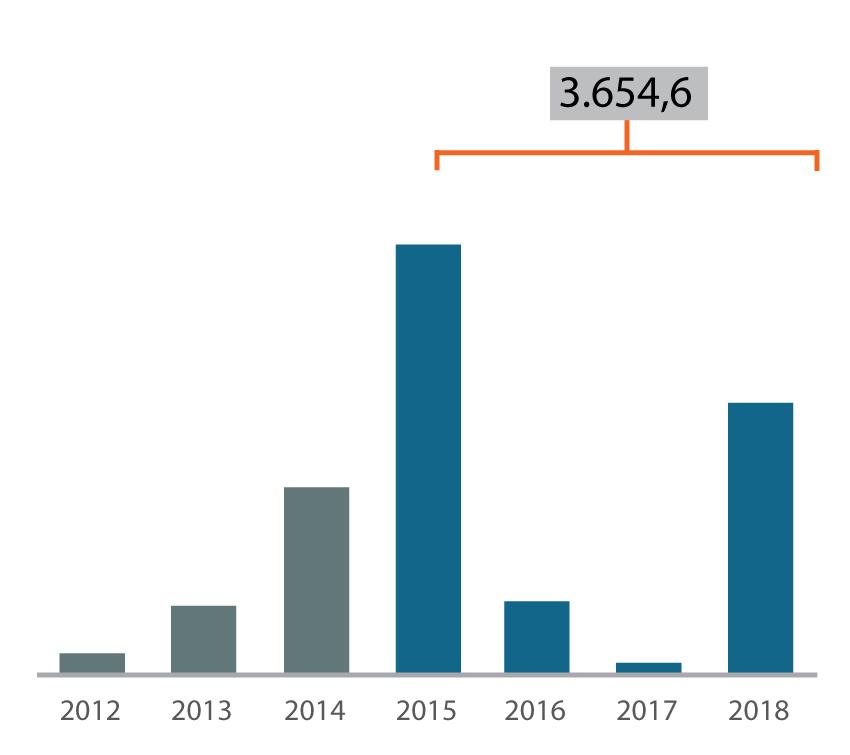

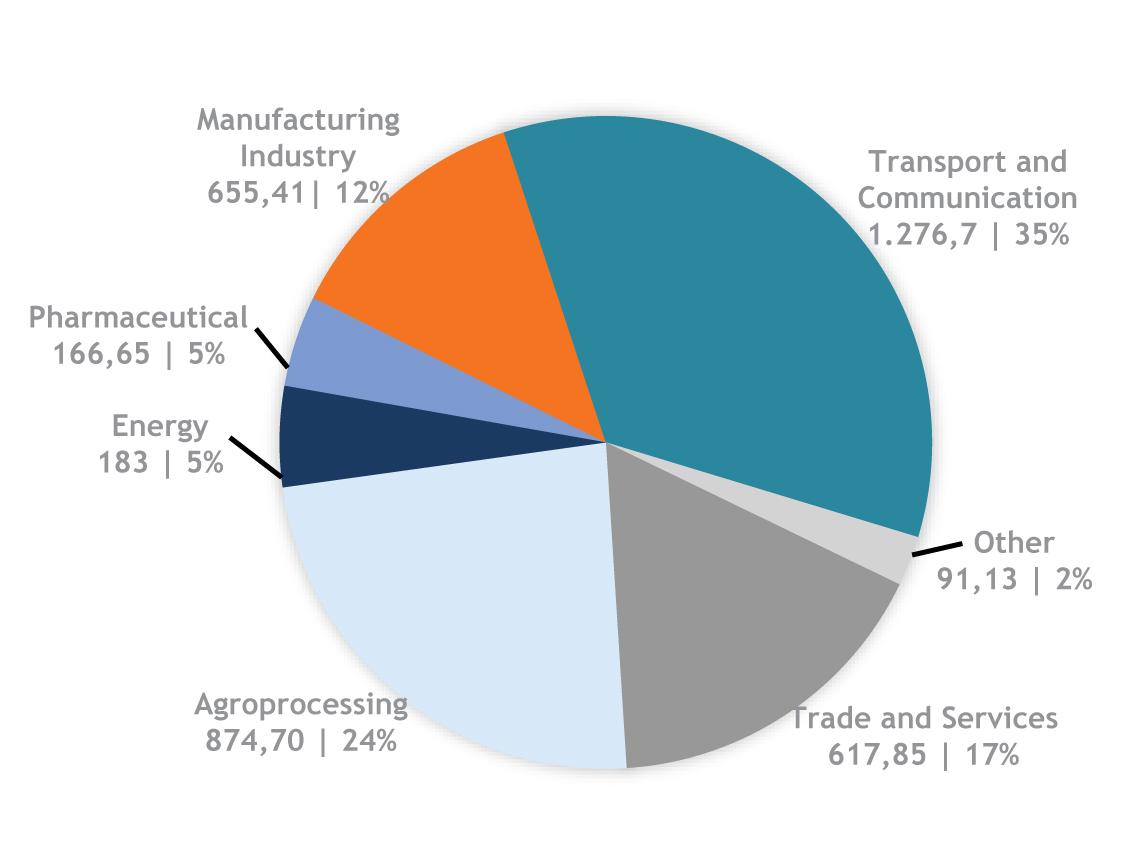

BNI’s activities are grouped into two business segments: Development Banking, and Advisory & Structured Finance. Under the Development Banking segment, BNI’s mandate is to promote the sustainable development of the private sector through long- and short-term lending to sectors which have a positive impact on the Mozambican economy. During the last four years, the bank has financed enterprises and projects worth MZN3.655m, 35% of this to the Transport & Communications sector and 24% to Agro-processing – in line with the government’s five-year Economic and Social Plan.

As a development bank, BNI’s role is to complement Mozambique’s commercial banking activity, therefore filling the gaps in credit and financing. To achieve this, the bank has been leveraging commercial banks’ single obligor limit by issuing bank guarantees for the execution of investment projects in a total value of almost MZN15bn. The issuance of these guarantees has resulted in income from commission, thus expanding the revenue base.

Multi-sector financing

BNI’s support of the agricultural sector is present right across the value chain – from production to trade. For example, the bank was involved in importing ™– agricultural equipment worth $33m through issuance of Letters of Credit to the Bank of Brasil. These assets allowed the government to establish various agricultural equipment shops along the country to benefit household farmers.

BNI has also supported the trade, processing and exportation of cashew nuts by financing leading market players to the tune of $20m. A significant part of the value is in gathering raw cashews from local communities, therefore the market contributes to an upturn in rural prosperity through the generation of jobs and income from exports.

In the Transport and Telecom sector, BNI financed the expansion of the communication networks through one of the largest telecommunications operators in the market. The financing, with a value of MZN150m ($2.4m) facilitated wider access and better quality of data services to the central and northern regions of Mozambique.

In Petrochemicals, BNI reinforced the fuel handling capacity of the biggest market players by financing the acquisition of fuel-filler cranes to the value of MZN78m.

BNI’s five-year strategy is fully committed to funding SMEs, irrespective of the challenges and complexities. SMEs are an essential part of Mozambique’s economy, making up over 80% of the companies in the country, and supporting them is vital. The bank has been working with development finance institutions, such as the Islamic Corporation for the Development of the Private Sector (ICD), tailoring products that meet the needs of niche sectors.

In 2018, BNI structured a $6.5m credit line for agribusiness in the central province of Tete. This facilitated financial access for agricultural SMEs in the Zambeze valley in central Mozambique. The initiative benefited almost 60 entrepreneurs in 2018 and there are 146 projects currently approved to receive funds.

The bank also signed an agreement to implement a government programme funded by the International Fund for Agricultural Development (IFAD). Worth a total amount of $62m, this countrywide Rural Enterprise Finance Programme (REFP) is expected to come into operation this year.

BNI also helped guarantee funds to support SMEs in the agriculture and livestock sector with an overall value of MZN250m ($4m). Funding small projects has a positive social impact, generating employment and self-sufficiency, and creating a network of local entrepreneurs who can then establish their own supply chains.

Fig.1: Mozambique’s net profits and dividends

Fig.2: Net assets and capital growth

Commercial pipeline

The bank has been highly successful in financing and structuring public and private projects, with a focus on the energy and oil & gas sector with a total amount of $262m designated. The bank has a significant number of energy projects under development, including plans to link and extend the energy supply across Mozambique.

BNI successfully executed the financial restructuring of public sector bodies including, Mozambican Airports, Mozambican Airlines, Petromoc and Municipality Public Transport Company, in order to generate self-sustainability and business cash flow. BNI was also involved in an advisory and fundraising capacity for Mozambique’s electricity company (EDM – Electricidade de Moçambique). This emergency programme aims to improve and expand the power network both domestically and for industry, therefore promoting industrial activity in the country.

In the oil & gas sector, BNI participated in the Coral South financing with the Trade and Development Bank (TDB), and is invited to participate in the Area4 as Local Content. This will include BNI participating as the agent bank to finance the ENH equity participation in the oil & gas projects.

In the capital market segment, BNI operates in both, primary and secondary markets in order to raise funds for SMEs. In the debt market, BNI organised and structured the issuance of corporate bonds and commercial papers for four companies with a value exceeding $20m. While in the equity market, BNI structured and submitted two companies for quotation to the Mozambique Stock Exchange (from a total of 10), therefore contributing to the development of Mozambique’s capital market.

Fig.3: Credit to the economy

Fig.4: Sectorial distribution of credit

Talent pool

In terms of human resources, BNI operates in a highly competitive market, requiring it to be agile in the face of new technology, laws, and regulations etc. BNI supports its team with training and career progression opportunities, giving every individual the chance to reach their full potential. In line with the bank’s expansion plans, 19 university-educated employees have recently been recruited. The graduates are from the Faculty of Economics from Eduardo Mondlane University with which the bank has a structured relationship.

To support the learning and development of its employees, BNI has launched a programme for individuals studying to Master’s level in areas of interest to the bank. This strategy not only contributes to the professional development of its employees but also to the long-term retention of talent.

The bank is comprised entirely of local staff, from the executive board to the administration team. BNI recognises that in order to become a market leader, it is crucial to adopt best practices in risk management and compliance, as well as recruit and train staff to adapt to an ever-changing commercial landscape. Therefore, alongside the financial support provided to employees through Master’s programmes, the bank has implemented a range of training programmes to help employees gain expertise in the various fields of the bank’s activity.

The bank’s CSR policy is focused on healthcare and education. In this field, we have been joining efforts with the government, non-profit organisations to alleviate the basic needs of the Mozambique population.

Further information