A mission to combat money laundering and terrorism financing

The Council of Europe’s monitoring body MONEYVAL evaluates anti-money laundering and terrorist financing in 34 jurisdictions

Established in 1997, the Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism (MONEYVAL) is a permanent monitoring body of the Council of Europe that evaluates anti-money laundering and combating the financing of terrorism (AML/CFT) systems of its 34 Members States and territories. MONEYVAL is one of the larger members of the Global Network of organisations led by the Financial Action Task Force (FATF) – the international AML/CFT standard-setter. As an FATF-style regional body and an FATF associate member, MONEYVAL uses the FATF Standards and Methodology to assess legal and institutional frameworks, and their effectiveness through a dynamic peer review process of its members.

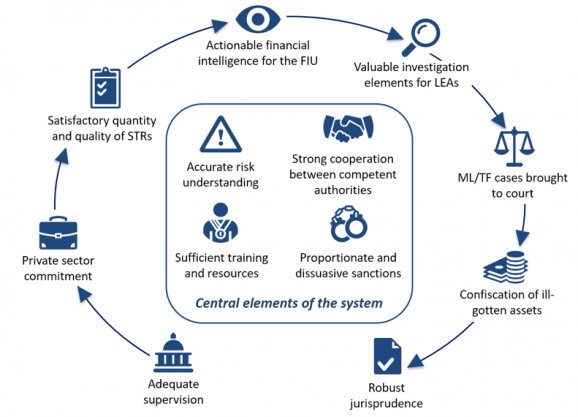

The scope of MONEYVAL assessments covers the sectors of banking, securities, insurance, currency exchange, money remittance, cryptocurrencies, gambling, accounting, real estate, precious metals and stones, trust and company services, notaries and the legal profession. MONEYVAL evaluates the work of key government agencies, including law enforcement authorities(LEAs), prosecution and judiciary, financial and non-financial supervisors, financial intelligence units (FIUs), and authorities involved in combating the financing of proliferation of weapons of mass destruction , including export control bodies. The evaluations examine the full effectiveness cycle of AML/CFT measures, starting from supervision of the private sector entities and their suspicious transaction reporting (STR), the use of this information by FIUs and LEAs, criminal cases and confiscated amounts. A proper assessment of national risks, effective international cooperation and adequate resources are important cornerstones of an effective AML/CFT regime.

The anti-money laundering cycle

The mutual evaluation reports of MONEYVAL include a set of compliance ratings, which are used by the financial sector to define risk thresholds in international business relations and transactions. MONEYVAL’s targeted recommendations assist national authorities in reforming their AML/CFT regimes, and are rigorously followed-up after the evaluation. Members performing poorly in their mutual evaluations or the follow-up process may be subject to additional measures to motivate compliance. Jurisdictions with the most severe deficiencies may be further examined by the FATF International Cooperation Review Group, resulting in a public listing of the jurisdiction in case of lack of progress.

MONEYVAL carries out crime typologies research and other activities to assist members in targeting actions against emerging money laundering and terrorism financing trends. As 2020 was marked by the COVID-19 pandemic, the recent research to categorise new types of AML/CFT criminal trends stemming from the crisis.

Further information