“Holy Grail of medicine” set to deliver blockbuster returns

John E. Kaye

- Published

- Home, Technology

2023 has all the potential to be a landmark year for medical breakthroughs, writes Richard Brown

“Follow the money” is an oft-used guidance in crime detective dramas, but it can equally be applied to medical innovations. Without reliable investment, healthcare breakthroughs simply would not materialise. People would not obtain the critical treatments they require; drug discoveries by the world’s leading pharmaceutical firms would dry up, and patients with otherwise curable conditions would needlessly suffer – and in some cases die.

Digital Health – the application of the latest, cutting-edge technology to accelerate drug discovery, treatments and revolutionary medical devices – is, of course, like any industry not immune to the overall global economic downturn. However, despite recessionary constraints, healthcare remains one of the most impactful industries.

And while the digital health sector has seen significantly less investor appetite in North America (Oct 2022: $16bn vs Oct 2021: $26bn; down 37%), funding in Europe is only down about 20% ($3.8bn) up to October 2022.

Meanwhile, the total in Asia Pacific is heavily hit by investors being highly reserved in China, which always represents the lion’s share of funding in the Asia-Pacific region. According to medical consultancy HealthTech Alpha, approximately one third of all investments in the digital health space relate to the oncology, mental health, women’s health, cardiovascular and neurology areas.

The reason for this, says Dario Heymann, Chief Research Officer at HealthTech Alpha, is that venture capital funding dedicated to disease-specific solutions increases with the establishment of more clinically proven ventures. “In the early days of digital health, the drive was towards raising awareness – hence the popularity of sites such as WebMD – or to provide easier access to physicians (think Teladoc, Babylon Health).

“Since 2015, experts in the field started seeing the establishment of ventures that are supporting patients and physicians to manage diseases or support the diagnosis of diseases, which is heavily data driven, otherwise known as ‘Digital Health 2.0’,” says Heymann. Owned by Singapore-based Galen Growth, HealthTech Alpha is the world’s only analytic platform for digital health that delivers accurate information to investors, industry innovation leaders and start-ups. Its aim to assist organisations and governments to shape their digital health strategies by providing insights and comprehensive sources.

Investor appeal

Oncology, cardiometabolic diseases – which include cardiovascular disease and diabetes, and mental health – are areas with huge spending, either by out-of-pocket expenses or reimbursements. Due to their social and economic impact they become highly attractive to investors.

Globally, priorities in healthcare are shifting towards modernised patient care by streamlining processes and task automation. Telehealth and telemedicine as we know it is becoming a common inclusion for both healthcare providers and insurance programmes with increased attention to the quality and outcomes of virtual care and the data-driven clinical decision-making. With the maturing of Digital Health, it is no longer sufficient to simply have a solution, but to clinically validate the outcome of the offering, especially when directly impacting the adherence of a patient or when supporting physicians in their clinical decision-making process.

Heymann encapsulates the route to market investors travel in their search for healthcare yield. “The driving factors are: 1) more sophisticated solutions that require capital to rapidly scale; 2) cost of validation for a solution to become clinically proven is high; 3) the market environment drove investors to make higher bets early – which was mainly in 2020/2021 and who are currently scaling back in 2022 due to economic turbulence and a drive to profitability.”

But investors hunting yield in healthcare have some tantalising precedents. Take American Big Pharma firm Amgen, one of the pioneers of biomedicine. Its investors earned as much as 46,000 percent on their money from just one drug, Epogen, used to treat just one illness, anaemia, in kidney patients. And the more money investors are prepared to plough into medical research and development, the greater the chances of hitting upon a blockbuster cure.

Oncology remains the highest invested therapeutic area, mainly due to the high financial burden across the value chain, from research to diagnosis and treatment. Research costs alone tally to more than $650m to bring a single cancer drug to market. Digital Health can help lower the cost with drug discovery or clinical trial supporting systems.

Within cancer diagnosis, new technologies help with the turnaround time of physicians, hence lowering manpower costs by helping with the interpretation of medical images. Also early diagnosis solutions, such as GRAIL’s Galeri test, will in 2023 ultimately help to lower the burden on society by diagnosing cancer earlier and hence averting the risk of critical illnesses and the consequential costs involved as a treatment can cost up to $1m – and hence even lower the cost of reimbursement for insurers.

So, investors are betting high on oncology as it remains the disease area with the highest cost burden, but has many touchpoints covered by Digital Health.

Holy Grail

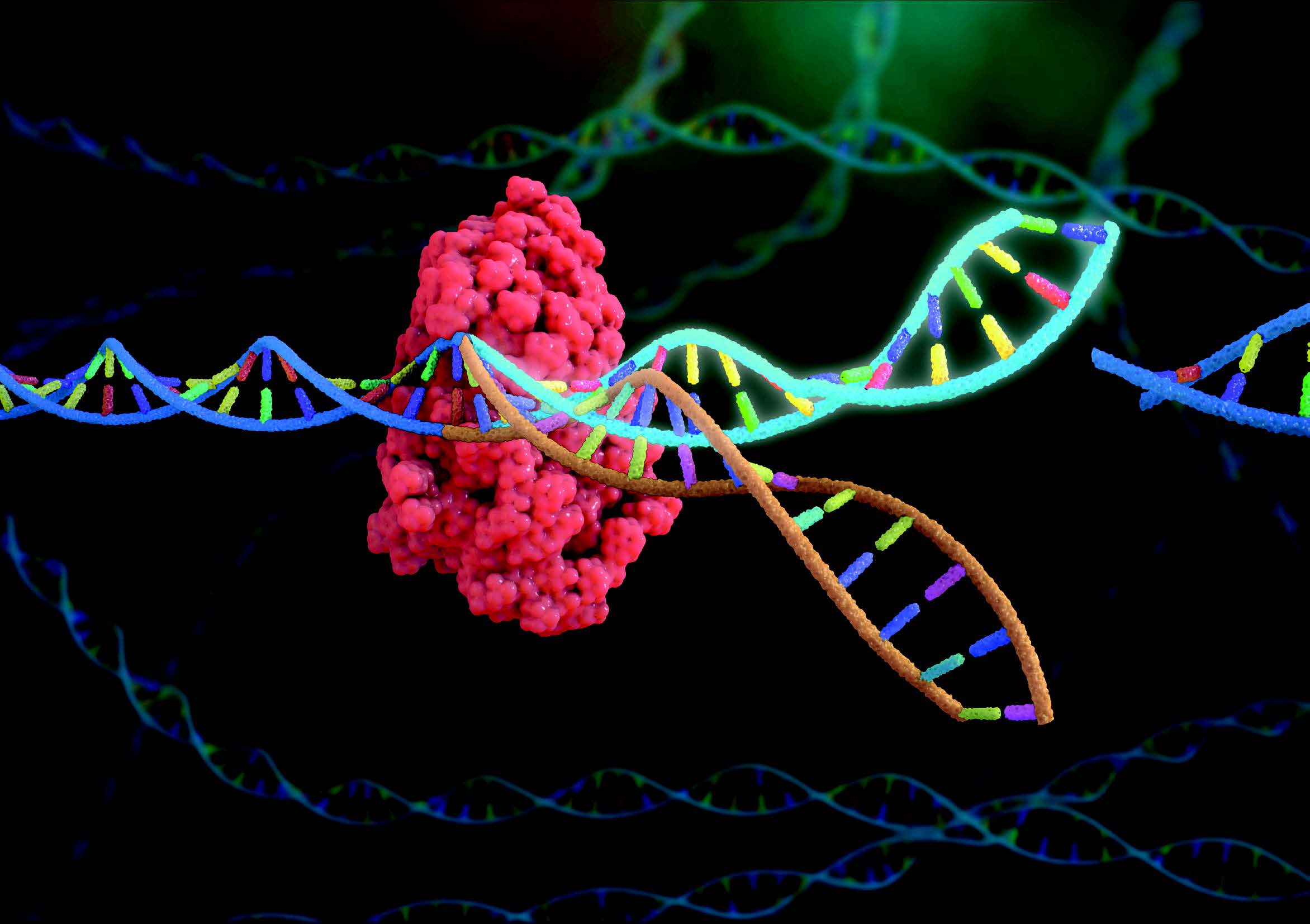

One stand-out discovery set to take the medical (and wider) world by storm by realising its full potential in 2023 is an innocent-looking liquid. A decade ago, the protein CRISPR-Cas9, an enzyme that bacteria use to attack viruses that infect them, was unknown.

Today, as a result of the pioneering work of NASDAQ-listed, Cambridge, Massachusetts-based Editas Medicine, CRISPR-Cas9 and its sibling enzyme Cas12a are acknowledged as the most efficient way of “cutting-and-pasting” DNA ever invented.

As a clinical stage genome editing company, Editas Medicine is focused on translating the power and potential of the CRISPR/Cas9 and CRISPR/Cas12a genome editing systems into a robust pipeline of treatments for people living with serious diseases around the world.

Scientists the world over are calling CRISPR-Cas9 the most consequential discovery in medicine. They say it’s giving them power they could barely imagine. Indeed, the Nobel Laureate committee called it “the Holy Grail of medicine”. And 2023 is destined to be the year many CRISPR-Cas9 therapies finally make it to market.

It works by “snipping out” small, badly repaired breaks that lead to malign mutations. Mutations can change how our cells function and may lead to serious genetic diseases such as sickle cell disease (SCD), Leber congenital amaurosis 10 (LCA10), cancer, and many others.

Right now, there is a total of 6,000 genetic diseases known to mankind, from liver disease, to diabetes to skin cancer. The list is seemingly endless. And what drug companies do is they pick one disease from the list at a time, then they try to create one drug to treat that disease. But there’s a problem with the system.

The average drug takes 10 years and costs $2.6bn to bring to market. Now, if the drug companies strike lucky, they find that their medicine can treat more than one disease, such as anti-hypertension drug Minipress which was created to treat high blood pressure but pharmaceutical giant Pfizer – who discovered it – learned it can also treat prostate cancer.

The problem is that only 300 drugs have to date been invented to treat 6,000 genetic diseases. What makes CRISPR-Cas9 so unique is that scientists believe it can treat all 6,000 genetic diseases.

IP tussles

If that sounds like science fiction, consider that the largest drug companies in the world have invested billions of dollars into this treatment: Juno Pharma invested $700m; Baxter invested $62m; GlaxoSmithKline just invested $350m; Johnson & Johnson invested $1bn; Allergen invested $90 million and Novartis a further $80 million. And that’s on top of the $120m Bill Gates and Google Ventures already invested into Editas.

But, as with all breakthroughs, intellectual property tussles surrounding CRISPR-Cas9 are to be expected. One research team, led by molecular biologist Feng Zhang at the Broad Institute of the Massachusetts Institute of Technology and Harvard University, has secured several key US patents.

The other team includes biochemist Jennifer Doudna at the University of California, Berkeley, and microbiologist Emmanuelle Charpentier, who began work on CRISPR techniques at the University of Vienna. In 2020, Doudna and Charpentier shared the Nobel Prize in Chemistry for their discovery of CRISPR-Cas9 gene editing.

Luckily for Editas, it enjoys being the exclusive licensee of the Broad Institute and Harvard University’s Cas9 patent estates and Broad Institute’s Cas12a patent estate for human medicines.

The current market capitalisation of Editas Medicine is just $2.5bn. But some enthusiastic Wall Street investment analysts believe that, given the enzyme’s potential to cure thousands of genetic conditions, the ground-breaking firm could be worth a trillion dollars, putting it in the same league as Facebook, Amazon and Google. Now that’s hardly a snip.

RECENT ARTICLES

-

Europe opens NanoIC pilot line to design the computer chips of the 2030s

Europe opens NanoIC pilot line to design the computer chips of the 2030s -

Building the materials of tomorrow one atom at a time: fiction or reality?

Building the materials of tomorrow one atom at a time: fiction or reality? -

Universe ‘should be thicker than this’, say scientists after biggest sky survey ever

Universe ‘should be thicker than this’, say scientists after biggest sky survey ever -

Lasers finally unlock mystery of Charles Darwin’s specimen jars

Lasers finally unlock mystery of Charles Darwin’s specimen jars -

Women, science and the price of integrity

Women, science and the price of integrity -

Meet the AI-powered robot that can sort, load and run your laundry on its own

Meet the AI-powered robot that can sort, load and run your laundry on its own -

UK organisations still falling short on GDPR compliance, benchmark report finds

UK organisations still falling short on GDPR compliance, benchmark report finds -

A practical playbook for securing mission-critical information

A practical playbook for securing mission-critical information -

Cracking open the black box: why AI-powered cybersecurity still needs human eyes

Cracking open the black box: why AI-powered cybersecurity still needs human eyes -

Tech addiction: the hidden cybersecurity threat

Tech addiction: the hidden cybersecurity threat -

Parliament invites cyber experts to give evidence on new UK cyber security bill

Parliament invites cyber experts to give evidence on new UK cyber security bill -

ISF warns geopolitics will be the defining cybersecurity risk of 2026

ISF warns geopolitics will be the defining cybersecurity risk of 2026 -

AI boom triggers new wave of data-centre investment across Europe

AI boom triggers new wave of data-centre investment across Europe -

Make boards legally liable for cyber attacks, security chief warns

Make boards legally liable for cyber attacks, security chief warns -

AI innovation linked to a shrinking share of income for European workers

AI innovation linked to a shrinking share of income for European workers -

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows

Europe emphasises AI governance as North America moves faster towards autonomy, Digitate research shows -

Surgeons just changed medicine forever using hotel internet connection

Surgeons just changed medicine forever using hotel internet connection -

Curium’s expansion into transformative therapy offers fresh hope against cancer

Curium’s expansion into transformative therapy offers fresh hope against cancer -

What to consider before going all in on AI-driven email security

What to consider before going all in on AI-driven email security -

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California

GrayMatter Robotics opens 100,000-sq-ft AI robotics innovation centre in California -

The silent deal-killer: why cyber due diligence is non-negotiable in M&As

The silent deal-killer: why cyber due diligence is non-negotiable in M&As -

South African students develop tech concept to tackle hunger using AI and blockchain

South African students develop tech concept to tackle hunger using AI and blockchain -

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year

Automation breakthrough reduces ambulance delays and saves NHS £800,000 a year -

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences

ISF warns of a ‘corporate model’ of cybercrime as criminals outpace business defences -

New AI breakthrough promises to end ‘drift’ that costs the world trillions

New AI breakthrough promises to end ‘drift’ that costs the world trillions