In an excerpt from the book ‘Disruption in Action’, Alexandra Jankovich, Tom Voskes and Adrian Hornsby describe why the tortoise beats the hare in digital transformation projects

A few years ago, Alpha Sapiens Capital, a private equity firm, bought Reeltime Rentals, a video equipment rentals company. Video production was booming, and rentals seemed like a steady, assetbacked way to play in the market. But soon the Alpha Sapiens partners spotted a new opportunity. Reeltime was continuously updating its rental stock, and so was producing a steady stream of ex-rental equipment that it sold to industry traders, who resold to market with a margin.

“We’re leaving lunch on the table here guys,” one partner remarked.

“Let’s sell the gear ourselves online,” said another.

And so they created GearHub.com as a digital startup. They had privileged camera supply, demand wasn’t a question, and all they needed next was someone smart to run it.

One option was Ben Foot, the CMO at Reeltime, but he was a bit of a tortoise in the partners’ opinion, and lacked vision. Then Klaudia Kvist appeared – an ex-consultant who’d worked in finance, and who was more their style. Like many smart people, they liked other smart people to look like themselves.

“This is a prime case for blitzscaling,” she announced. “Think Uber, think Airbnb, think 10,000x. Blitzscaling is when you prioritise growth over efficiency to win the market. After total victory, you fix the problems.”’

“Sounds good,” the partners smiled.

Blitzing smart

Klaudia knew that to succeed she had to be fast, but also superior, and for that she had a strategy. The used camera market at the time was rife with haggling and dodgy equipment, but she could use AI to calculate optimised fixed prices and accurate lifetime predictions, supporting great warranties.

She hired six data scientists and put them on it, and five web developers and five operations people. They blitz-built the site in 10 weeks and launched in Germany, where the competition was dusty secondhand shops and peer-to-peer sales. They were an AI-powered megastore and blew the lot away. In two months they were the No.1 camera site in Germany, but didn’t stop to celebrate because they were already launching in Austria, Belgium and the Netherlands. In three months they were No.1 in all of them and launching in the next three, then five. By the end of the year they were in 12 countries with sales of €20m.

But there were problems: every new country meant a new language, new VAT rules, new banks and regulations. They now had web developers in 12 countries patching solutions and instant messaging, while irate customers were calling up about things that didn’t work. To which Klaudia’s response was always, “Yes but not now, because we’re blitzscaling.”

And the proof was always the sales: they were posting 10% a month top-line growth. Alpha Sapiens was convinced and kept driving in the investment cash.

Four “why’s”

Two years in, GearHub was in 23 countries and had over €60m in sales, but now growth was slowing. Why? The first answer was that each new country was giving them less of a bump, and in existing ones, things were flatlining. Why? Klaudia had no idea? Why not? Because she had no data. Why did she have no data?

Product-first mindset

Klaudia had directed all her AI and smarts at camera pricing and warranties – essentially, the product side. But on the sales side, she’d been tracking only two KPIs: total sales and total number of products on the platform. Now sales were thinning, she could only say that products were still coming through. Were there problems with the site? Certainly. Were customers still making angry phone calls? Yes, but Klaudia had outsourced customer services. The question of what to fix first and how to prioritise was looking overwhelming, but just then, a window opened …

When the Covid-19 pandemic hit, all industries suddenly wanted to get into video streaming and camera demand went through the roof. However, to everyone’s surprise, GearHub.com sales nosedived. “This is wrong,” Klaudia told the partners on Zoom. “We should be going vertical. Let’s invest more and blitzscale into Asia.”

They agreed it was wrong, but not on the solution. “You’re fired,” they said, and clicked End Meeting.

When to blitz

Meanwhile, Ben Foot – the tortoise from Reeltime – was in the business news. Two years previously he’d left to become CEO of a music equipment website, and had just sold it to Yamaha. The partners bit the bullet and called him up, and he agreed to look over the books and come in.

“The problem,” Ben said, “is that you’ve been blitzscaling while being loss-making on every customer. You must have burned a bag of money.”

It was true – growth had always been very investment-driven, and the €60m in sales had cost €92m. But established digital wisdom was on their side – as Klaudia had always reminded them: winner takes all, follow top-line growth, seize the first-mover advantage, and so on. After all, Amazon had been loss-making for its first nine years.

“True,” Ben said, “But blitzscaling only makes sense when you’re very sure of three things:

- The market really is winner-takes-all: it often is with services that customers use all the time, like Google or Amazon, because you get a lock in. But with less frequent purchases, like expensive cameras, customers will shop around each time so the market stays labile.

- The competition is moving fast: in digital, if a competitor gets far ahead it’s very hard to catch up, but there’s little real advantage in being first off the blocks. Facebook, Airbnb, Zoom and many others weren’t first; they just scaled aggressively when their markets were exploding.

- The realisable market is huge and you’ve got deep pockets: because if you’re in a cash-burn race with other investors, you can’t run out first, and the market better be worth it. Blitzscaling’s trophy example is PayPal, but that’s a $20bn global payments system. How much is the used camera market worth?’

The partners were going from pink to purple. “What do you propose?” one blurted out.

“Blitzshrink,” Ben said. “Scale back to your five core markets and get the per-customer economics down. And yes, I’ll take the job.”

Re-start-up: the platform is the product

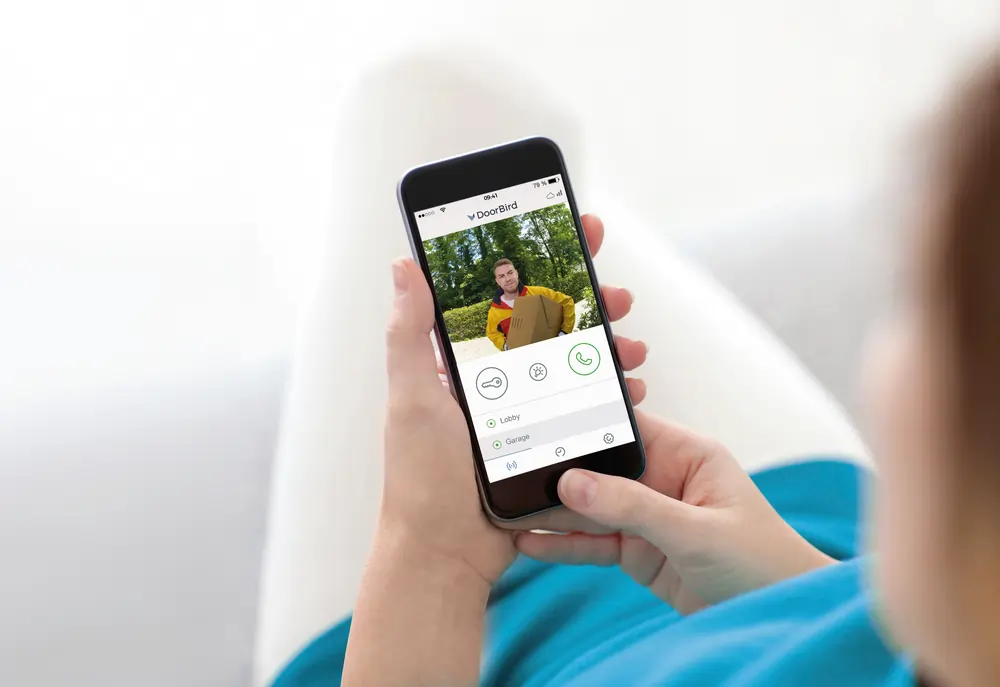

Ben’s first puzzle at GearHub was the four whys Klaudia had blanked on, and he soon found the key: click-to-reserve. Prior to Covid, customers could reserve a camera online and then go to a Reeltime Rentals depot to complete the purchase (where it still went through the GearHub site). This was a popular option, but with the depots now in lockdown, those sales evaporated, revealing how weak fully online sales always were. This was also why growth had been flatlining prior to Covid: they’d only been able to sell in areas near Reeltime depots.

“But why don’t customers buy online?” The COO asked Ben. “Is it the problems with the site we haven’t fixed?”

“God yes!” said Ben. “Online, customers expect things to ‘just work’ – no ifs, no buts. It sounds simple, but requires a lot of work at the back end. For example, to get delivery right, our stock management has to be perfect; and pricing can’t display differently in different places; and if a customer clicks on something, they have to land on the right spot whatever phone they’re using. It’s so obvious but so often forgotten: in e-commerce, the customer journey has to be seamless from end to end – anything less and the sale will drop.”

“So we need to knuckle down and fix every bug?”

“Yes, but it’s more fundamental,” Ben went on. “We also need to study and optimise. When you built the site, you made thousands of tiny choices – the look and feel, the navigation, the filters. We need to watch customers moving through and see where they’re dropping off, and ask, “What’s happening there?” Then we devise solutions and run A/B tests to see which works better; then run the tests again with new As and Bs, and again, and again, gradually learning and iterating toward an optimised site.”

“And we do all this before we blitzscale?”

“We do it continuously,” Ben said. “Sites like Amazon aren’t static. They have literally 10,000+ versions running at any one time on which they’re continuously testing and tweaking everything. They do it at the country level, the customer segment level, and down to the individual customer, which is the Holy Grail. It’s a tremendous amount of extremely detailed work, but it’s what’s got them so far ahead of the competition. And what’s keeping them there is that they have: The customers numbers to run that many tests, and, the organisational capabilities to keep analysing results and acting on them – which means improving things for customers.”

Klaudia had thought of the cameras as the high-value items, but had massively underestimated what it takes to build a high-value platform. Indeed, in serious e-commerce, the platform is the product. What you’re selling on it and where you get that from is just a little shopkeeping work.

Bold vision, tempered with visibility

In one sense, this is a cautionary tale about the hare, the tortoise, and the private equity firm that tried to back the hare. But it’s also about having confidence in the tortoise route. The granular systems that Ben went on to implement gave him and the partners excellent visibility into operations, meaning they could see both where the detail problems lay and how fast improvements were moving numbers in the right direction.

This is reassuring to the risk-averse, as it allows you to contain costs while you’re in the test-and-learn phase, and stop if things aren’t working. Digital venture does require bold vision, but always tempered with visibility.

The case study in this excerpt from ‘Disruption in Action’ is based on real life events. However, the names of the people and companies involved have been changed.

ABOUT THE AUTHORS

Tom Voskes and Alexandra Jankovich are the co-founders of digital consultancy firm SparkOptimus. Adrian Hornsby (right) is an award-winning writer and editor. They are the co-authors of ‘Disruption in Action: 7 inside stories of how global companies take on digital disruption’.